Ottawa is once more retooling its economic relief efforts addressing the COVID-19 crisis, in a bid to help students and struggling businesses.

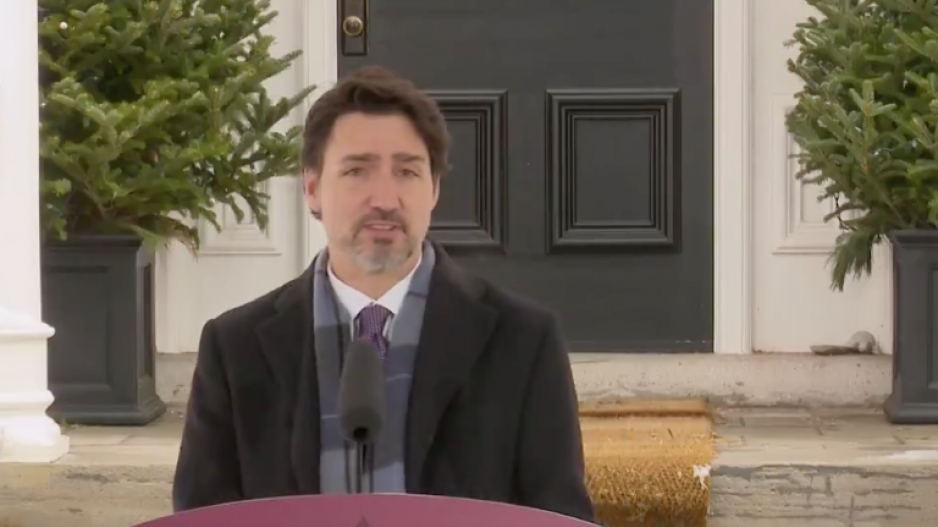

Prime Minister Justin Trudeau announced Wednesday (April 8) that organizations participating in the Canada Summer Jobs Program will get a subsidy of up to 100 per cent from government to cover the cost of hiring students.

Many young people find themselves in a precarious position as studies wrap up at the same time the pandemic is grinding economic activity to a halt.

The federal government will extend the timeframe for job placement to the winter to accommodate the fact many jobs won’t be able to begin until later in the year.

Trudeau said more measures to help young people, gig workers and vulnerable seniors will soon be announced.

He also revealed businesses seeking assistance from the government’s wage subsidy program will now have to show a 15 per cent revenue decline in March compared with a year earlier.

The federal government originally required businesses to demonstrate a 30 per cent revenue decline to qualify for the Canada Emergency Wage Subsidy program.

Those eligibility requirements drew criticisms from industry groups, which raised concerns that many small businesses or high-growth companies would not qualify.

Trudeau said “there are going to be gaps” when developing such economic measures so quickly.

He also acknowledged government now realizes much of the economic impacts of the pandemic did not manifest for companies until midway through March, making that month a more problematic reference point.

The prime minister clarified businesses can now choose to use January or February as a reference period rather than March.

Charitable organizations can also choose to exclude government subsidies when making their calculations.

The $71 billion wage-subsidy program was originally introduced at 10 per cent with only small businesses eligible.

It was boosted to 75 per cent in late March with a wider variety of organizations now eligible.

The subsidy will be backdated to March 15, while the program will run 12 weeks until June 6.

The subsidy will cover up to 75 per cent on the first $58,700 an employee earns — a maximum of $44,025, or $847 a week — regardless of the size of the company for which he or she works.