Canada’s mortgages in arrears rate is low compared to other advanced economies, the Canadian Bankers Association reported with the release of March mortgage data on May 30.

“Canadians are ... careful borrowers and this is evident when looking at national mortgage delinquency rates in Canada that show that more than 99 per cent of mortgage holders in Canada are in good standing,” the association reported.

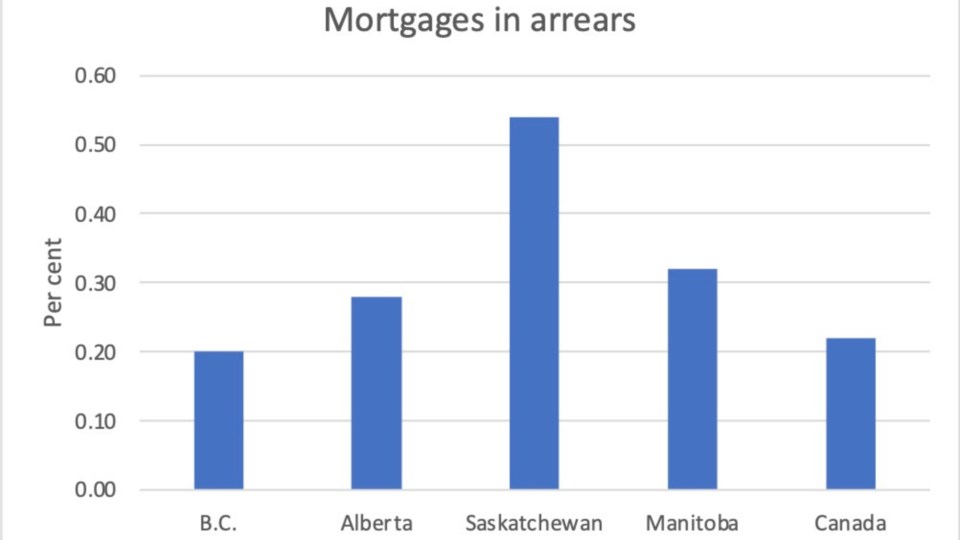

Just 0.22 per cent of mortgages nationally are in arrears, defined as three months or more behind in payments. This is significantly lower than in either the United States or the United Kingdom, where the most recent figures show arrears rates of 1.52 per cent and 0.74 per cent, respectively.

Canada's rate is at the lowest level in decades, according to the association.

Saskatchewan reported the highest rate of mortgages in arrears both in Western Canada and nationally in March, at 0.54 per cent. This was more than twice the national rate of 0.22 per cent and nearly three times B.C.’s rate of 0.2 per cent.

Arrears rates are considered a lagging economic indicator because the financial impact of bad economic news typically takes time to play out. Arrears rates during the COVID-19 pandemic, for example, took approximately a year to peak within Western Canada before starting their downward trend.

Rebecca Casey, president, Canadian Mortgage Brokers Association – British Columbia, said she has seen a rise in consumers refinancing properties this spring. This is because higher interest rates and inflation in recent years have caused many households to accumulate more debt.

With files from Jami Makan