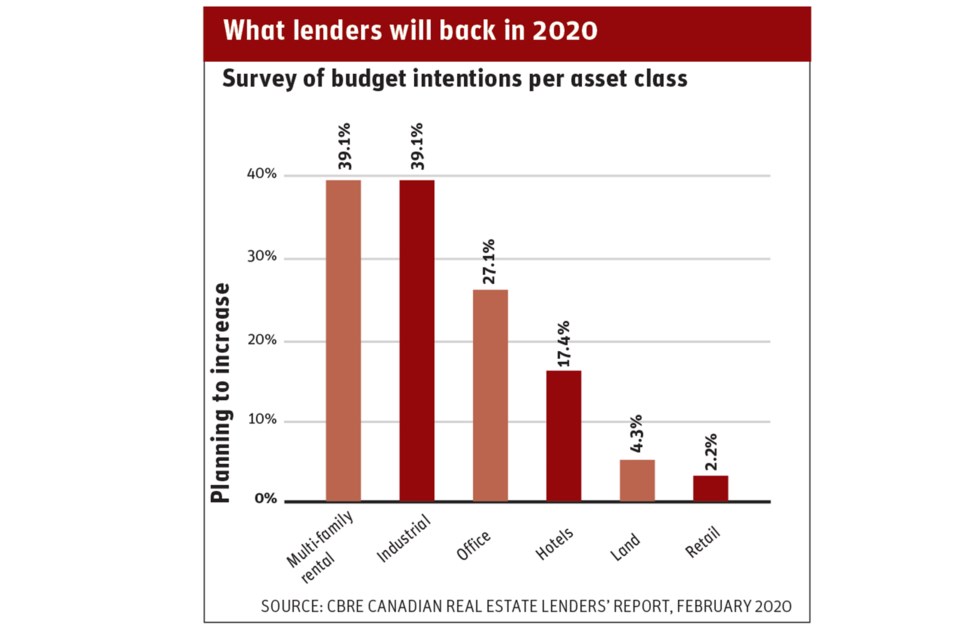

The relative stability and high yields offered by the real estate sector have attracted increased capital and investment activity over the past few years. However, even as Canadian real estate fundamentals reach record levels, lenders are mindful of the prevailing worries over the retail sector, according to CBRE’s most recent Canadian Real Estate Lenders’ Report.

Lenders overall are focusing on quality assets, and some have become a bit more selective with where and how they choose to deploy their capital.

Sentiment surrounding retail assets continues to languish and lenders have become increasingly averse to the sector. Since 2016, the number of respondents that wholly discounted retail assets from their budgets has grown steadily to 39.1 per cent of lenders in 2019. In terms of budget allocations for 2020, 26.1 per cent of lenders reported intentions to decrease their exposure to retail. Furthermore, of the asset classes that cause concern for lenders, four of the top five spots are occupied by select retail formats: regional secondary markets, power centres, value-add and entertainment and food services. The exception remains grocery-anchored properties, with which lenders are comfortable with as an asset class.

Asset valuations were a major factor for lenders this past year and even caused some lenders difficulty in meeting their budget plans. Looking ahead to 2020, lenders expect asset valuations and pricing returns to be the top microeconomic factors in making their lending decisions next year.

In Alberta, lenders have not entirely ruled out the market nor have opinions changed materially since the downturn in energy prices. Most respondents expressed interest in lending in Calgary and Edmonton, the survey found.