B.C.’s real estate recover continued apace in February, with the total value of all home sales at $4.4 billion, up 41.4 per cent from a year ago, the British Columbia Real Estate Association (BCREA) reported March 12.

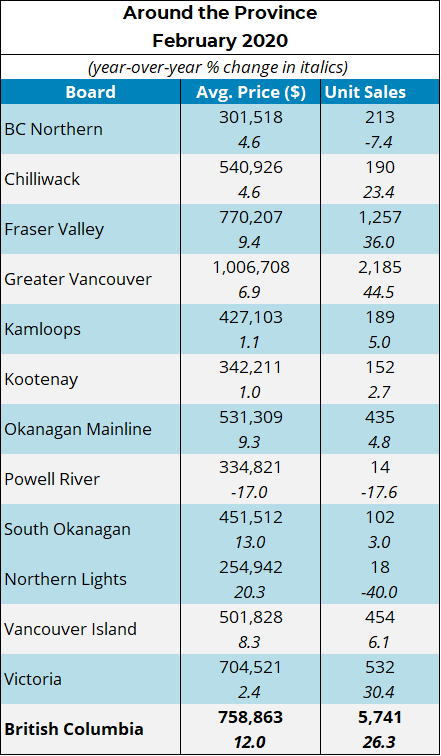

There were 5,741 residential unit sales were recorded by B.C.’s MLS last month, which is an increase of 26.3 per cent from February 2019

Added to that, the average MLS sale price in B.C. last month was $758,863, a 12 per cent increase from one year previously.

However, all that improvement is in comparison to the weak activity seen in early 2019, and merely brings the provincial real estate market back to normal levels.

“Housing markets in BC continued to trend near long-term average levels in February,” said Brendon Ogmundson, BCREA’s chief economist. “Recent declines in mortgage rates and favourable changes to mortgage qualifying rules may provide a boost to home sales heading into the spring, although there is significant economic uncertainty lingering over the outlook.”

With total B.C. MLS home listings down 8.3 per cent year over year, and sales increasing, the ratio of sales-to-active residential listings across B.C. rose to 20.3 per cent. It is considered a seller’s market only when the ratio is above 20 per cent for several months, so the market is still considered balanced at this point.

As ever, the picture changes dramatically when looking at individual real estate markets, with some recovering more than others, and some struggling.

Greater Vancouver saw the biggest sales increase (but not the biggest price rises), while the small markets of Northern Lights and Powell River both saw fewer sales than in February last year. Of the larger markets, only B.C. Northern reported a decline in transactions compared with its active market of one year ago.

Average sale prices rose on an annual basis in every B.C. market except Powell River, which is small enough to see wild percentage changes in sales and prices, and therefore does not indicate a trend. Of the larger markets, the highest average annual price rise was in the Fraser Valley, up 9.4 per cent, followed by Okanagan Mainline and Vancouver Island.

Check out sales and prices in your region, below.