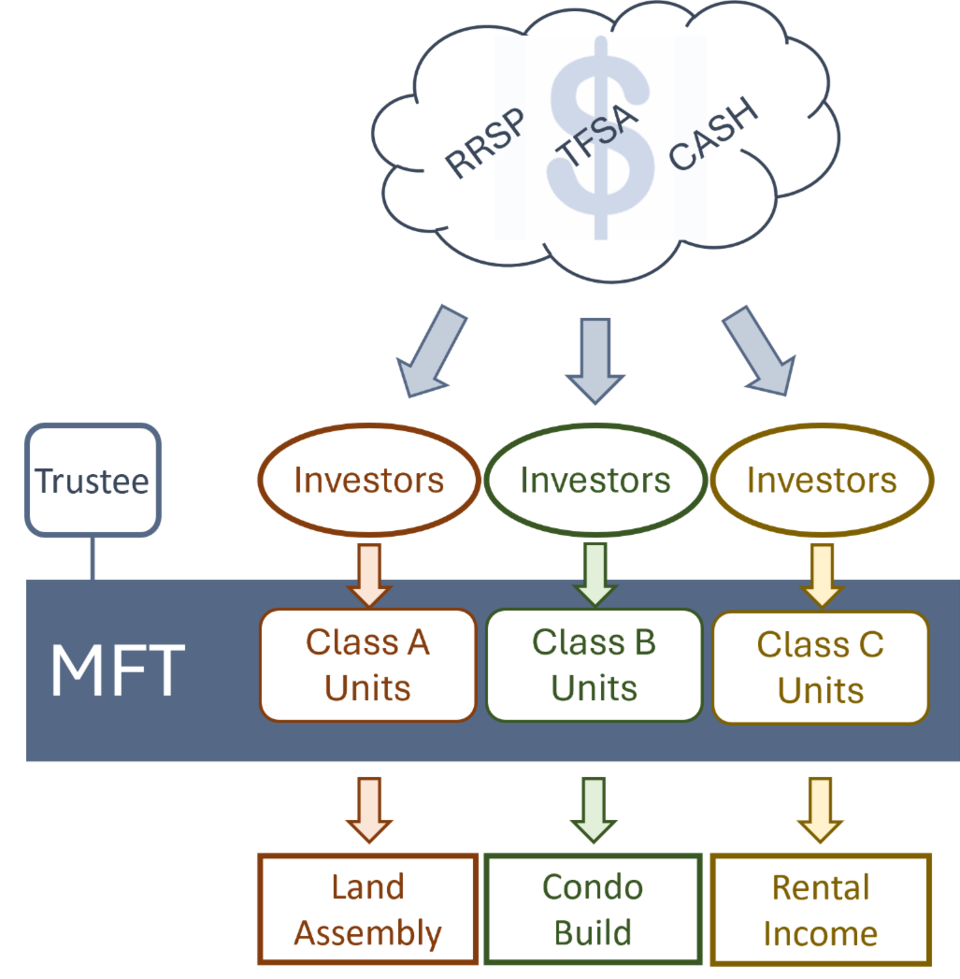

Axiom Advisors Inc's unique Mutual Fund Trust (MFT) offers flexibility to developers and provides investors with registered funds, like RRSPs and TFSAs, the opportunity to use those funds when investing in real estate projects.

An MFT operates similarly to a limited partnership, but with a trustee in place of a general partner and unitholders instead of limited partners. And, what really sets it apart from a limited partnership is the unique advantage of allowing investors to utilize their RRSP or TFSA to invest directly in the mutual fund trust. This key distinction marks a significant and advantageous feature of the MFT structure.

While the MFT concept isn’t necessarily new, Axiom’s take on it is. Other iterations of the MFT structure are limited in scope and do not provide the minimum 150 initial investors that CRA requires. Axiom’s turnkey MFT provides both.

A big advantage for developers is that Axiom's MFT enables them to manage multiple offerings across various projects through a singular MFT structure while maintaining distinct isolation between different classes. Each class of units in the MFT will continue to be eligible to receive registered funds – RRSPs or TFSAs – from investors and will provide tax-efficient, flow-through features for each project. Axiom works with their clients to ensure that the MFT is set up to maximize attractiveness to investors and to maximize the tax-efficiency of profits.

This innovative MFT allows all types of income and capital gains to retain their characteristics and be passed through to the MFT investor — an extremely attractive and salient point for investors.

“What attracted me to Axiom’s MFT structure was the uniqueness that allows me to raise funds from investors with registered accounts while developing multiple real estate projects using one MFT. Since each project is isolated from the other projects, it effectively reduces the cost of the MFT,” describes Leslie and Jamie Collard, owners of Collard Properties Inc.

Axiom can also perform all the necessary administrative work (accounting, tax reporting, subscription agreements, security filings, investor distributions and investor communications) which allows the developer to focus on raising capital and managing their projects - Axiom takes care of everything else.

“Working with Axiom to set up the MFT was seamless,” says Mimi Fei and Alejandra Moreno, owners of Honeybee Development Group Ltd. “Axiom guided and advised us throughout the whole process. They are a very experienced team.”