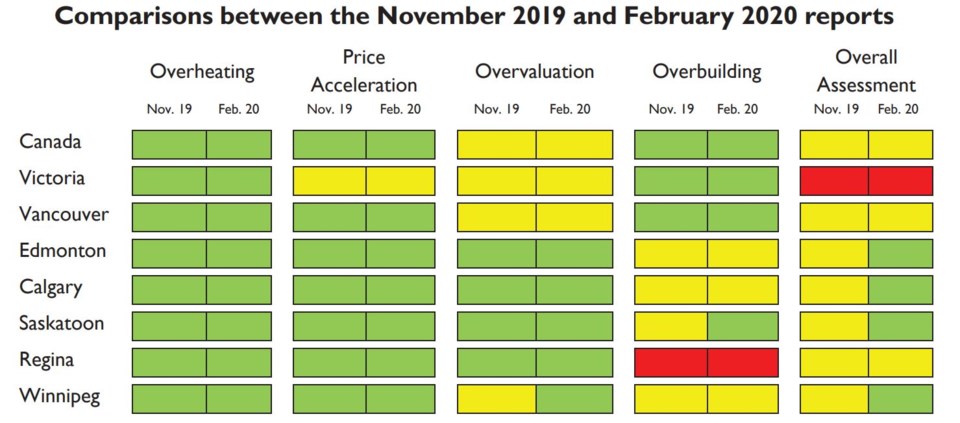

Several Prairie cities saw their housing market ratings downgraded to a “low degree of vulnerability” in the quarterly Housing Market Assessment (HMA) released February 20 by Canada Mortgage and Housing Corp. (CMHC).

CMHC’s HMA examines urban real estate markets across Canada, assessing a combination of four key risk factors: overvaluation of house prices in comparison with levels that can be supported by economic fundamentals; overheating, when demand for homes in the region outpaces supply; sustained acceleration in house prices; and overbuilding, when the inventory of available homes exceeds demand.

In its latest HMA examining markets in 2019’s fourth quarter, Saskatoon, Calgary, Edmonton and Winnipeg were all downgraded from a “moderate degree of vulnerability” to the low-risk rating.

Of the Prairie cities covered, only Regina remained at moderate risk, due to persistent evidence of overbuilding, according to the CMHC.

Goodson Mwale, senior analyst economics at CMHC, said, “The persistence of higher inventories over the past year together with an elevated rental vacancy rate have led us to maintain our high rating on overbuilding.”

With home prices remaining muted after a recent correction, Metro Vancouver’s housing market has retained its “moderate degree of vulnerability” rating. The region’s only factor that remained at moderate risk was overvaluation of real estate, while the other three factors were all at low risk.

The report found that Greater Victoria’s housing market remains at an overall “high degree of vulnerability” due to a combination of moderate risks of both price acceleration and overvaluation.

Victoria was the only area in Canada to have been given this high-risk rating. Toronto and Hamilton stood at “moderate” ratings like Vancouver, and all other Eastern cities remained at a low-risk rating.

Overall, Canada’s national housing market was rated “moderate” with the same valuations as Metro Vancouver across each risk factor.