It’s been a just over a week since Donald Trump was announced as the next president-elect of the United States, and media outlets across Canada have weighed in on how Trump’s presidency will affect Canadian real estate investment. Business analysts, journalists and everyone in between appear divided on the Trump effect, but one thing is certain: everyone seems to have an opinion one way or the other.

Now that the dust has settled, we’ve narrowed down the top four post-Trump real estate impact articles, as part of a newly launched blog series, Weekly Buzz, in which we will curate a content round-up from various media outlets to encapsulate what's new and notable in the Western Canadian commercial real estate industry.

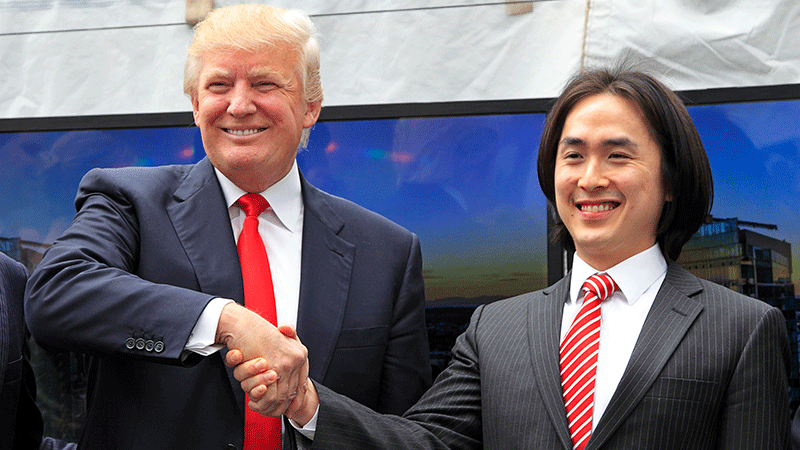

Don’t expect a post-Trump surge of Chinese real estate investment – The Globe and Mail

The Globe and Mail reports that according to a leading China-based real estate website, Juwai.com, Chinese investors don’t see a Trump presidency as a reason to shy away from American investment in favour of Canadian investment – unless Trump makes a drastic move.

Juwai.com surveyed more than 500 Chinese international property buyers before the election, and nearly half felt Mr. Trump would be good for Chinese investment in that country. Mr. Pittar added, however, that since the results of the election were a surprise, some institutions may hold back on investment in U.S. property as they wait to see what happens next.

“Family and individual investors are much less likely to hold off,” Mr. Pittar says. “That large majority of transactions by volume are actually made by individuals and families.”

Still, all that could change if Mr. Trump does something that registers as truly unsettling to the Chinese international property buyer or to the U.S. economy, he adds.

“That’s when we would see a shift of investment to Canada.”

If it really does come to pass that Chinese investment in U.S. property declines, Canada could pick up some of that traffic. This is especially true for prospective buyers swerving away from California, Washington State, Illinois and Michigan, he says. When people have to make a substitution, they tend to look for a market with similar characteristics to the location they were first scouting.

Western Investor editor, Frank O’Brien, predicted last week that if Trump enacts trade restrictions against China – which were to include a 45 per cent tariff on Chinese imports, according to Trump – Chinese investors maybe begin to look toward Canada as a more flexible business partner.

Canadian REITs are at risk to falling prices under a Trump Administration – Financial Post

A new report by RBC Capital Markets cited by the Financial Post says Canadian real estate investment trusts are susceptible to potential price drops, as Trump’s policies may lead to inflation and a rise in interest rates.

That will be particularly harmful to Canada’s real estate investment trusts, which have benefited from the low interest rate environment in recent years. REITs typically offer higher yields than other stocks, which means when interest rates are low, investors flock to them for a bigger payout.

“In a rising interest rate environment, we believe virtually no REIT or REOC share price will be ‘spared’,” said Matthew Barasch, Canadian equity strategist at RBC Capital Markets. “With the Canadian REIT structure now well over 20 years old, it would seem that the long-term trend in interest rates (i.e., downward) has provided a tailwind to the sector through much of the prior two-plus decades.”

Trump effect blamed as mortgage rates rise and bonds tumble – CBC

Senior producer at CBC’s business unit Don Pittis believes that if an interest rate increase spills over into Canada due to a Trump presidency, house prices will drop. Without the extra spending money allowed by higher lending rates, the housing market will be affected. Less access to borrowed money means Canadians can afford less, causing housing prices to fall, negatively affecting both borrowers and lenders.

Trump's promise to spend $1 trillion and cut taxes has bond (and mortgage) markets worried that Federal Reserve Chair Janet Yellen must begin to raise interest rates.

[…] Rising interest rates would eventually have the same effect on houses that it has already had on bonds. Higher rates make existing assets fall in value. In both cases there will be large effects on the wider economy as asset values disappear.

If that happens in the property market, Canadians will not like the feeling.

[CBC]

However, our editor, Frank O’Brien, believes that the Trump administration may lead to lower Canadian mortgage rates in the long run, provided a surge in the American dollar stalls U.S. Feds plans to increase interest rates in the States.

Vancouver real estate searches from U.S. sources triple after Trump win – REW.ca

Regardless of divided opinions, stats don't lie: REW.ca saw its web traffic from U.S. IP addresses searching for housing in Canada increase dramatically following election night. Visits to the site's listings portal rose 226 per cent the day after the election. While this doesn't mean every (or any) curious searcher will actually follow through with immigrating to Canada in the wake of Trump's election, it does show there are quite a few Americans toying with the idea.

The total proportion of US visits to REW.ca rose from an average of 3.17 per cent of all the site’s sessions, to 10.56 per cent on November 9.

The majority of the searches were from Los Angeles, Seattle, San Francisco, New York and Chicago – all in Democratic strongholds.

From California, which accounted for 35 per cent of REW.ca’s US-based traffic, searches on the listings portal rose by 272 per cent the day after the election, Wednesday November 9, compared with November 2.

The number of new users coming to REW.ca from California quintupled in that time, rising exactly 400 per cent.

[REW.ca]

REW.ca also narrowed down the top five most-clicked homes by American users during the post-election listing search surge - and the property that generated the most interest from potential American ex-pats is a home you could sail away on. Well, not exactly.