With the need for rental housing dominating the headlines, it’s easy for industrial assets to get outshone. However, this slightly less provocative asset class is highly coveted, providing ample opportunity for growth.

The situation

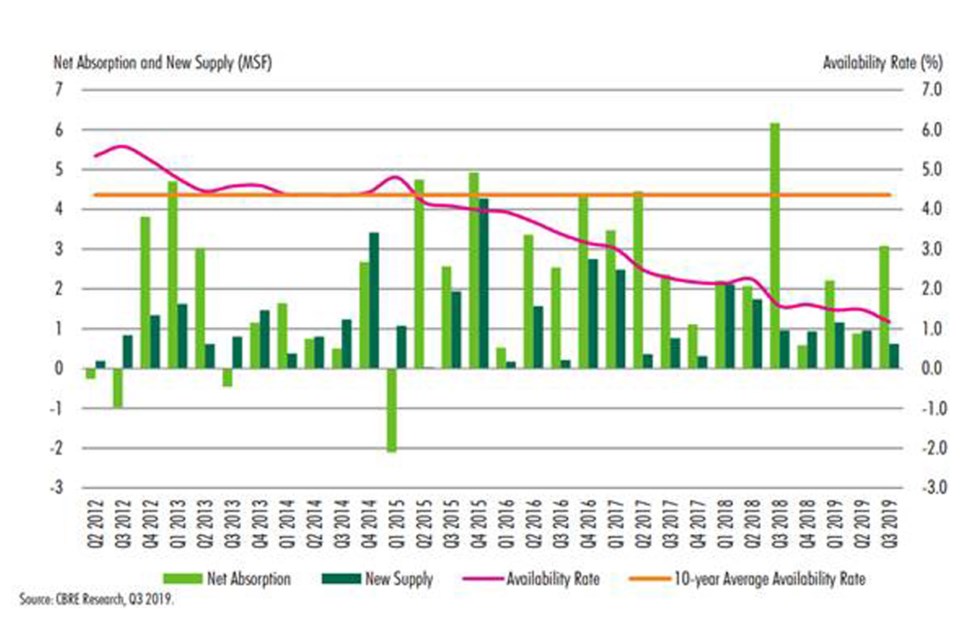

Simply put, the current state of the industrial market is stressed; with a lack of supply, inflated rents and challenges slowing new developments, industrial property users are fighting an uphill battle. The national industrial vacancy rate is 2.9 per cent, according to CBRE’s third-quarter 2019 report, with Vancouver seeing a 1.4 per cent, which is an all-time record low.

The inadequate supply of industrial space is a key factor to rents doubling over the last eight to 10 years. In Vancouver, net rental rates were stagnant in the $6- to $7-per-square-foot range for 20 years, but have recently escalated to the $8- to $13-per-square-foot range, depending on the location and size of the unit.

While there is a general shortage of all industrial space, the small and mid-bay (2,500 to 20,000 square feet) users are particularly impacted, as opportunities for units of this size are uncommon. Due to extreme land prices, industrial properties with excess land area are being marketed at inflated prices and being rezoned into higher-density properties.This makes it uneconomical for the traditional owner and/or user and ultimately pushes demand away from urban centres into outlying markets.

There do not seem to be any signs of reprieve with booming e-commerce, film production, last-mile delivery and distribution industries continuing to require space in the Greater Vancouver area. This growing demand is only going to put more stress on the industrial marketplace.

The obvious solution is to provide more supply, which is easier said than done. This year Metro Vancouver will welcome three million square feet of new industrial inventory, according to Avison Young’s Q3 2019 industrial report.

While there is some new space coming to market, soaring land prices, increased cost of labour and materials and extensive waits for approvals add to the overall cost for developers.

The solutions

All is not lost. There are solutions and all levels of government can lend a helping hand. Starting on a municipal level, government can find efficiencies to expedite the approval process to ensure new supply finds its way to market. Furthermore, municipal governments could take a closer look at the very high development cost levies. These costs could be lowered to offset the upfront cost of a new project.

Provincially, the Property Purchase Tax on land acquisition is a significant burden and disincentive for developers. The province could offer enticing low interest rate construction financing to industrial developers as the federal Canada Mortgage and Housing Corp. does with multi-family rental apartment buildings, essentially incentivizing new development.

The goods and services tax (GST) is also a deterrent for developers bringing new industrial product. This cost is passed down to the tenant and adding to already bloated rents. The federal government can make a significant impact by eliminating GST on new buildings. This is a successful practice in areas of the United States where they have identified “opportunity zones” and “property tax holidays” to encourage new development.

The opportunity

The industrial asset class is, in our opinion, one of the safest asset classes for commercial space in the Vancouver area, as indicated by the immense demand. The need in the marketplace creates a promising opportunity for investors. Investors and wealth managers have identified a need for both “lease” and “strata/condo” product, which has helped direct acquisition strategy. Capitalizing on this opportunity, Nicola Wealth has purchased properties for its Canadian portfolio, currently holding 12 industrial properties in British Columbia alone.

To help ease the pressure within the marketplace, we’ve developed these properties into mixed-use industrial/office building space. These projects are designed to appeal to the small-bay industrial user who could acquire units as small as 3,000 square feet or combine multiple units to obtain larger premises. Notably, the majority of our projects were 100 per cent pre-sold or leased prior to construction, further affirming the volume of users seeking quality industrial space of this kind and the significant investment potential.•

Mark Hannah is the director of real estate for Nicola Wealth of Vancouver. Hannah oversees the acquisition and management of a $3.5 billion portfolio of real estate throughout Canada and the United states for Nicola Wealth Real Estate, the in-house real estate division of Nicola Wealth. Visit: nicolawealth.com