With Metro Vancouver rental apartment buildings selling for record prices – the average is more than $240,000 per suite with high demand – it may appear simple for a landlord wishing to retire to list up and cash out into a white-hot market.

Yet a closer look shows that, with some planning and work, an apartment owner can not only upgrade the current rental income but also add increased resale value to the property.

If you are a typical apartment building owner in Metro Vancouver, your property is probably at least 50 years old. Increasingly, long-term owners are facing the stark reality that their net income is eroding as rents from tired or poorly managed assets fall ever below market norms. Exacerbating the worry of diminishing returns is the growing need for major capital replacements. Beyond the usual expenses, such as painting, flooring and appliances, owners have to contend with unpleasant capital cost items such as roofs, piping, elevators, balconies, windows and the dreaded underground parkades and related concrete and water problems.

While such capital expenditures don’t necessarily generate higher rental income or attract new tenants, remediations are necessary for keeping buildings efficient over time.

Many single-building owners, often with second-generation family members guiding operations, don’t realize that they’re only earning a subpar 2 per cent to 2.50 per cent return on investment even though they’re aware of the elevated value of their assets in today’s market. Their properties are seriously underperforming.

As commercial agents specializing in rental apartments, the Goodman team sees and appreciates the big picture.

We understand landlord-tenant relationships. Yet we’re often surprised, if not disappointed, at finding rents for seemingly decent suites at 20 per cent to 30 per cent less than market average. Sustaining rents significantly below market not only means thousands of dollars lost annually but also severely decreases an asset’s resale value.

Take a look at how this works.

Picture a typical one-bedroom suite in a 56-year-old wood-frame building in Vancouver’s South Granville, generating only sub-market income. According to Canada Mortgage and Housing Corp., a one-bedroom in this neighbourhood average $1,156 per month. Surprisingly, when we inspect buildings in South Granville, we sometimes discover that the one-bedroom rent is just $900, with parking and laundry components similarly below market. Acknowledging that the rent is under market, the owner rationalizes that lower rents mean less turnover and less need for expenditures on upgrades, allowing the landlord to sleep easier. Let’s not forget the equally appreciative tenants who also enjoy their sleep, stretching one-year leases into 10-year stays.

Many an owner thus overlooks what the new entrepreneurs on the block recognize only too well: that the older, inefficient suite in South Granville could, with a major retrofit, command monthly rent of $1,575, so as to compete with a 10-year-old condo rental.

Often unwittingly, the owner thus subsidizes a very grateful tenant to the tune of approximately $675 per month. Upgrades might include a modern kitchen and bathroom, a new washer and dryer, fresh flooring, a renovated lobby and new windows, to name a few. There are many investors keen to buy underperforming properties in good locations and upgrade them to market value.

Here is an example of what can be done.

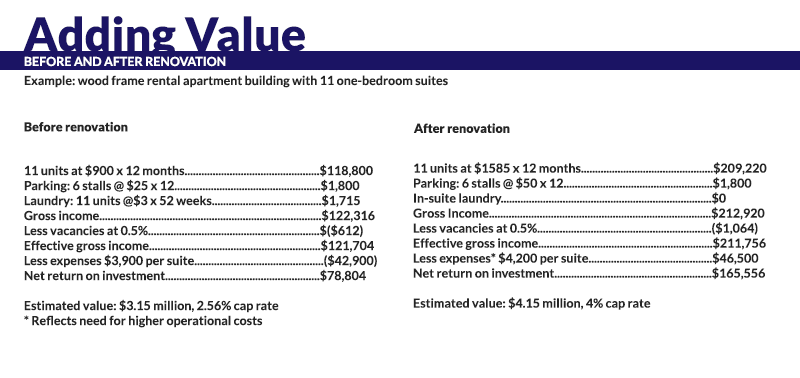

Assume that an 11-suite non-renovated building sells for $3,150,000 ($286,000 per suite) and a 2.5 per cent cap rate. This building’s operating statement, shown on the left-hand column of the chart below, could very well transform into the version shown on the right, should the building undergo a major retrofit and achieve the gross income indicated.

Fully realized, the value jumps by one million dollars to approximately $4.15 million ($377,000 per suite), effectively generating a 4 per cent yield. The cost of the upgrade is about $40,000 per suite or $440,000, resulting in a profit of roughly $560,000.

While this is only meant as an exercise, rental apartment buildings are valuable assets, and we strongly encourage landlords maintain their property and optimize rents.

Land values

The value of the land normally accounts for 75 per cent to 90 per cent of the assessed real estate value of an older apartment building. As a building ages, it normally depreciates, while at the same time, the land value continues to rise. Before demand took off for densification (also called “intensification”), few older buildings in any asset class were torn down. Today, demolitions are commonplace where permitted, as higher densities in many instances have effectively caused many older properties to be reclassified as “land value.”

When a developer identifies a property as having potential for higher density – such as proximity to transit stations or re-zoning a municipal official community plan – the development company typically prepares a proforma. This is a detailed financial analysis used to calculate the highest amount that a developer can pay for the land and still make a reasonable profit after building. The developer determines whether this figure, called a “land residual,” is higher than the existing use of the property. If it is, the developer may aggressively seek to purchase the property. If not, then the developer won’t acquire the site.

It is best to talk to an experienced real estate professional to determine if your apartment building is to be sold as an on-going rental income generator, or has potential as a land development sale.

- Mark Goodman is part of the Goodman Team at HQ Commercial, Vancouver and a specialist in the multi-family rental market in Metro Vancouver. Goodman can be reached at 604-714-4790. The team publishes the annual Goodman Report (www.goodmanreport.com).