Toronto’s economy continues to grow at a brisk pace with over 63,000 jobs added to the market in the second quarter (Q2) of this year.

Office-using industries grew by over 2.3 per cent. Leading contributors to this growth include professional, scientific and technical services as well as finance, insurance and real estate. Both sectors grew by 6.4 per cent for a combined total of 46,300 jobs added.

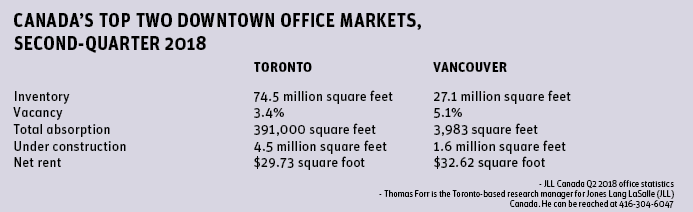

Downtown positive absorption and leasing activity continue to accelerate past expectations as well. The market posted over 725,000 square feet of positive net absorption this quarter, driving the already tight vacancy rate down to a record low of 3.4 per cent.

And it’s only going to get tighter from here.

Tech incubator OneEleven expanded by 49,000 square feet at 325 Front Street West while Google leased a total of 47,000 square feet on the last two available floors at 100 Adelaide Street West, the newest office tower downtown.

And that’s not all.

Two more tenants are moving downtown from the suburbs after closing the largest deals of Q2. Tim Hortons will relocate its Oakville headquarters to nearly 55,000 square feet of podium space at 130 King Street West in 2019. Ontario Teachers’ Pension Plan (OTPP) will anchor Cadillac Fairview’s 160 Front Street West, leasing 240,000 square feet on nine floors. OTPP will be moving from its current headquarters when the 1.2-million-square-foot office tower is completed in fall 2022.

Outlook: With the announcement of 160 Front Street West and The Well towers reported to be in the final stages of anchor negotiations, we currently track more than nine million square feet of committed construction, most of which will arrive in 2021-22. That’s the largest area under construction in almost three decades. The market needs more supply but the question shifts to how tight the market becomes in the lead-up to 2021. Is a 0 per cent vacancy unfeasible? At the current momentum of demand, we’re 12 months or less from a zero- per-cent vacancy rate. It’s a distinct possibility,

Vancouver

Vancouver’s downtown market continues its hot streak with a year-to-date absorption of 548,029 square feet, which has already surpassed 2017’s total of 488,401 square feet. The increased absorption has resulted in vacancy rates dropping rapidly. The total vacancy has dropped 210 basis points from 7.2 per cent at the end cof 2017 to 5.1 per cent in Q2 2018. Vacancy rates are predicted to drop further as a total of 500,000 square feet of space is currently vacant and leased with occupancy dates for 2018.

Large blocks of space are limited in the downtown market and those that are available are going for a premium. AAA quality space now leases for between $40 and $45 direct asking net rent. We will see some relief in 2020 when a predicted 580,000 square feet of new space comes to market, but it will not be until late 2021 or early 2022 that significant amounts of new supply will move the downtown into a more balanced market.

Outlook: We anticipate continued strong demand for office space. Until new supply arrives, downtown tenants will be competing for space, likely resulting in increased rental rates and a flight to the suburbs.