Commercial real estate sale values in Metro Vancouver fell nearly 50 per cent in the first quarter of this year and sales velocity plunged 36 per cent from a year earlier.

Calgary and Edmonton are both struggling with high office vacancy rates, which have cooled the retail sector in Calgary and saw April post the lowest monthly commercial sales in Edmonton in 19 years.

It could be time for real estate investors to swivel their sights towards northern British Columbia, where the largest resource infrastructure projects in Canadian history are laying the groundwork for a property bonanza. Right now, before the oil and natural gas pipelines become full – and thousands of workers and scores of companies fire up – could be the time to act.

Western Investor has pulled together some of the enticing real estate opportunities in industrial, commercial and multi-family plays, now being offered from the Peace River to the northern coast.

Knitting this vast region together are pipelines, including the network that will link the northeast gas fields with the LNG Canada export terminal at Kitimat, a $40 billion project in all, that will make Canada an international player in the liquefied natural gas (LNG) industry.

Then there is the $5 billion Trans Mountain oil pipeline, now owned by the federal government, that will eventually pipe Alberta oil into northern B.C. and down to export terminals in Metro Vancouver.

LNG Canada has already started and a final “go” decision on Trans Mountain was announced in June.

Prince George, as the biggest city in the north, will receive a lot of LNG business, but the logistics of pipeline delivery mean that Dawson Creek, Fort St. John, Terrace, Kitimat, Prince Rupert and many other northern towns and First Nations communities, will share in the riches for years to come.

Here is a sample of real estate plays that big-town investors may want to consider:

Industrial

A package in Prince George includes 2.6 acres of industrial land on Airport Road with a 14,000-square-foot warehouse/office building with 21 offices and two boardrooms. There are drive-through industrial bays with up to 16-foot overhead doors and a 10-ton crane. Ready to capture pipeline action, the property is priced at $3.2 million. Kathy Miller, Re/Max Action Realty, holds the listing.

Also in Prince George, a 3.6-acre site is cleared and levelled as one of the last heavy-industrial sites adjoining active rail service. On 72 Street and accessible via the East By-Pass Road, the parcel is priced at $1.05 million. It’s listed by Kathy Miller, Re/Max Action Realty.

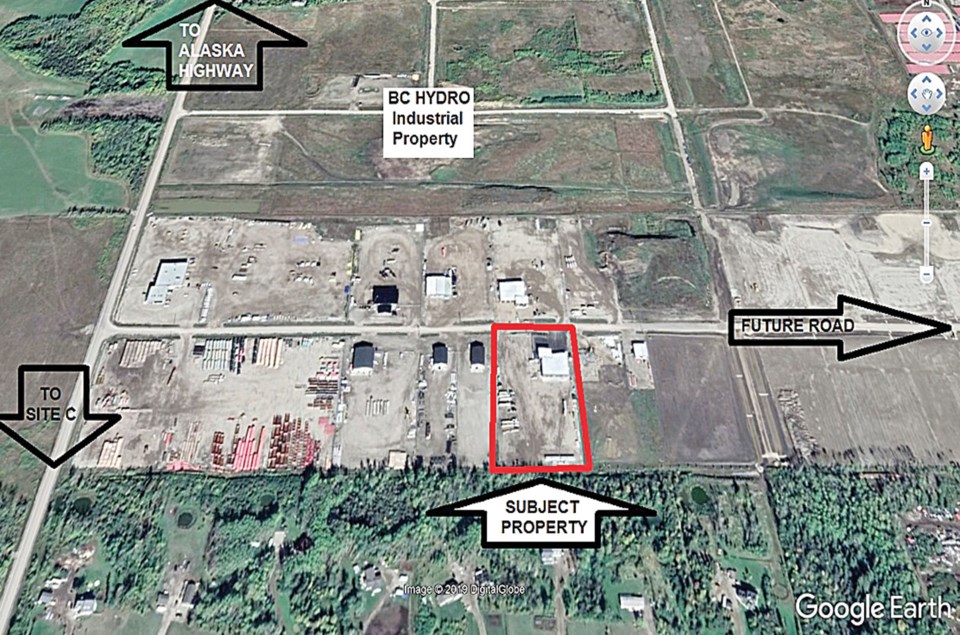

Available in Fort St. John, the second-biggest city in northern B.C. and a pivot city for LNG pipelines, is a 4.5-acre industrial site on Enterprise Way that includes a modern 13,407-square-foot light industrial/office building. It’s listed at $5.9 million by Ron Rodgers of NorthEast BC Realty Ltd.

Another opportunity in Fort St. John is a 15,000-square-foot industrial shop/office on a 1.3-acre lot that would be “ideal for corporate headquarters.” It is listed at $3.2 million by Ron Rodgers of NorthEast BC Realty Ltd.

A 0.4-acre industrial site is listed with two buildings totalling 8,393 square feet in Dawson Creek, a key town for the LNG pipeline expansion. There are two leasable areas with traffic exposure. The price is $475,000 through agent Kevin Pearson of Century 21 Energy Realty of Fort St. John.

Terrace is about a 30-minute drive from Kitimat, future site of the new LNG Canada terminal, and 90 minutes from the Port of Prince Rupert, and is seen as a prime staging and transport area. There are fully serviced industrial lots available in the giant new QETDZ Industrial Park Development, in parcels from two acres to 27 acres, even larger if needed. Long-term leases are being sought, but there is a potential to buy as well. The listing agent is Rick McDaniel of Re/Max Terrace.

Commercial/office

An investment property in downtown Prince George is an upscale office building with a strong tenant mix, including a major law firm, an international engineering company and health-care firms, in 33,835 square feet. It is listed at $9.7 million by Don Kehler of Powerhouse Realty, commercial-industrial division.

A downtown Fort St. John retail location on a near-half-acre lot covers 56,585 square feet leasable and currently houses two restaurants, but it could be converted to a strip mall with three spaces. There is plenty of parking on the site. It is listed at $1.8 million by Kevin Pearson of Century 21 Energy Realty.

Multi-family

You could become a landlord mogul with the purchase of a nine-property rental building portfolio in Kitimat, where thousands of workers will be arriving to build and manage the giant LNG Canada terminal, not to mention pipeline workers and related contractors and suppliers. The portfolio contains a total of 263 units, 110 of which are condos, and 100 are fully furnished. Nearly 140 of the units are being held vacant so a buyer can achieve maximum income from new tenants. The portfolio is offered at $34.5 million (about $131,000 per door) by Bruce Long of Macdonald Commercial in Vancouver.

Long also has a 178-acre residential subdivision site available in Kitimat that has the potential for 700 view building lots, detached or multi-family.

In Terrace, a flat, 1.6-acre multi-family development site in a central location is listed at $960,000 by Clint Dahl of Royal LePage Prince George.