With Canada’s extreme desirability as a post-secondary education destination, both local students and hordes of international students are vying for a limited supply of student housing.

Investors looking to make the most of this hot demand with student rental units that make the grade can turn to a new report called The University Effect by the Real Estate Investment Network (REIN).

The report cites a Globe and Mail article of January 2019 that says 97 per cent of students live in off-campus, unaffiliated housing in the regular rental pool. But, REIN says, students have particular needs and demands that differ from the rest of the rental population.

The report also points out that when an area has a university, this can drive up all local rental rates and decrease vacancies. They also boost the local economy in myriad ways and, according to the report, boost local employment by 4.6 per cent.

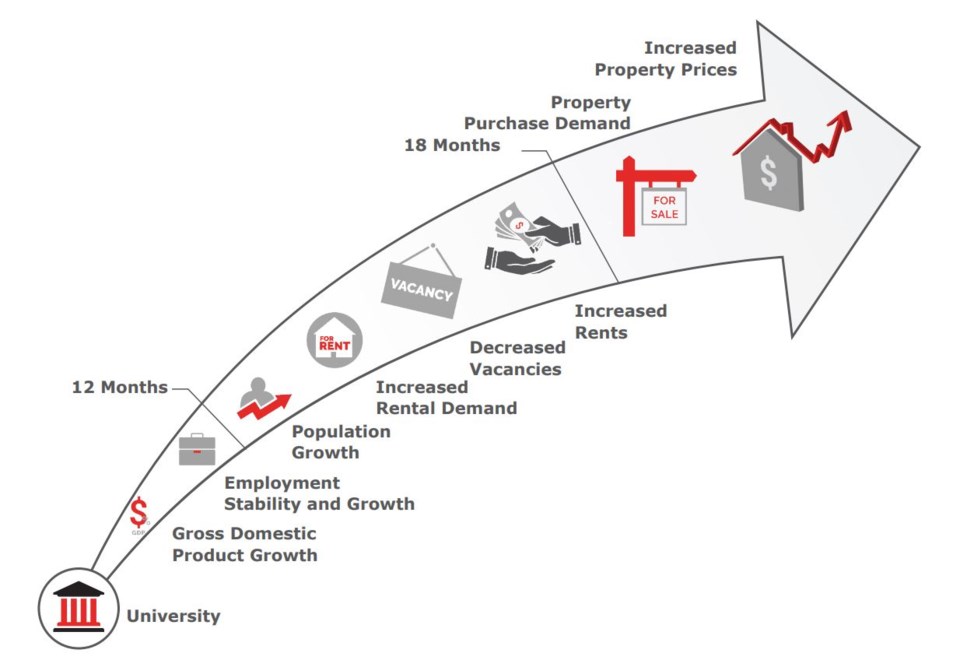

REIN identified a series of knock-on effects on a local economy that mean the “university effect” is something that all investors need to consider:

1. The employment of staff and the spending of the facility, its staff and students in the community;

2. Population growth is increased when the school attracts students (and staff);

3. The influx of residents increases the demand for rentals in the town, often closest to the university. This leads to decreased rental vacancies, which ultimately increases rental rates for the right properties, which in turn leads to increased demand for and the value of property;

4. Ultimately, an increased rental market leads to an increased housing market (see graphic below).

REIN’s report identifies ways in which investor-landlords can make their rental housing attractive to students, such as:

• dividing homes up into single-room units for maximum revenue;

• buying properties in locations with great WalkScores (students often don’t have vehicles);

• investing in properties in areas that offer direct transit links to the campus;

• buying properties with two or more bedrooms, as students often can’t afford to live alone;

• including furnishings, gas, water, heat, cooling, and high-speed internet in the rent; and

• advertising to older graduate students if concerned about tenant quality.

The REIN report also identifies the best areas in specific university cities for student-housing investors to buy, based on campus proximity and transit links.

Click here to download the full report.