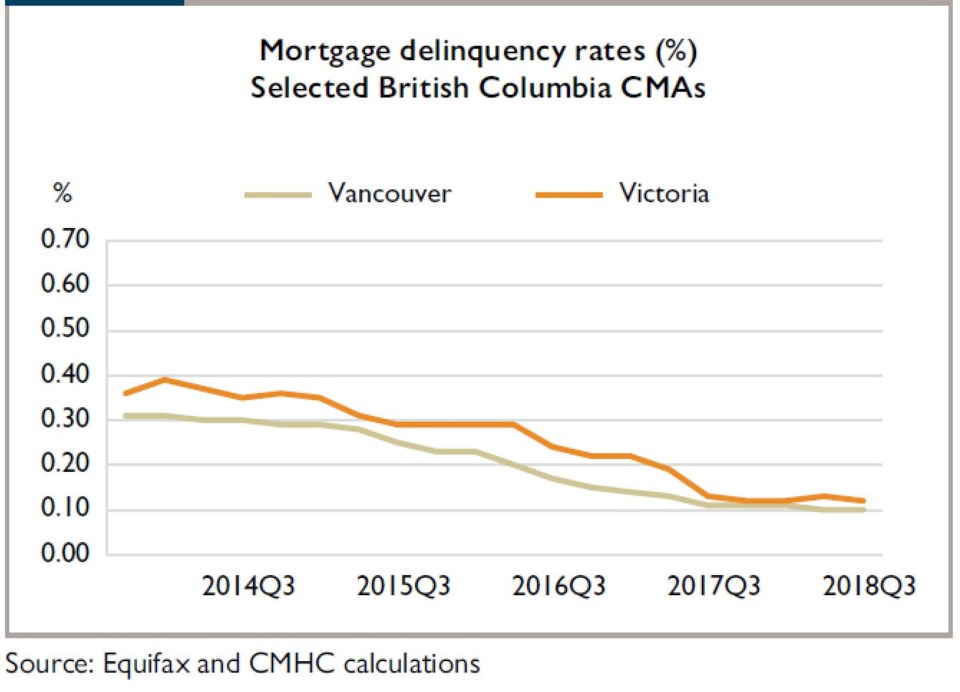

The proportion of Metro Vancouver and Victoria homeowners who are three months or more behind on their mortgage payments is falling, and has been dropping for years, according to Canada Housing and Mortgage Corporation data released February 27.

Only 0.10 per cent of mortgages in Metro Vancouver were delinquent in 2018’s third quarter, down slightly from 0.11 per cent in the same quarter of 2017, said the federal housing agency. In Greater Victoria, the figure was 0.12 per cent, down from 0.13 per cent the previous year. Both figures are below the provincial average of 0.16 per cent mortgages in delinquency.

Despite the surge in home prices over 2015-2017, mortgage delinquencies in the two urban centres have been in steady decline since 2014. However, although the Q3 2018 figures show another drop, the rate of decline has largely flattened over the year between Q3 2017 and Q3 2018.

CMHC said in its report, “A pullback in MLS sales combined with slowing job growth and rising interest rates up to Q3 2018 has contributed to slower growth in credit in the Vancouver CMA, resulting in the flattening of the delinquency rate trend."

The decline in mortgage delinquencies may seem surprising, given that average monthly mortgage payments in Metro Vancouver had risen by 6.3 per cent year over year in Q3 2018, according to CMHC.

The report authors said, “Increasing average monthly mortgage payments reflect elevated house prices resulting in larger mortgages, as well as rising mortgage rates and their impact on carrying costs.” Even though home prices have fallen on an annual basis over the past few months, in 2018’s third quarter (July through September), Metro Vancouver home prices were still higher than one year prior, and interest rates rose several times.

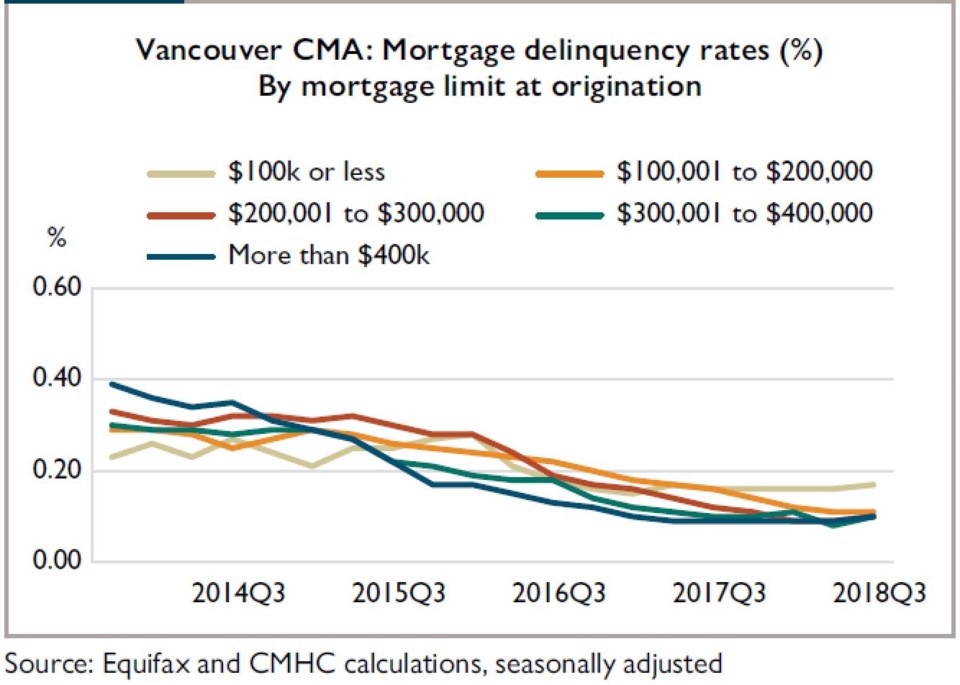

When broken out by mortgage amounts, Metro Vancouver homeowners with higher mortgages tended to have more steeply declining delinquency rates. This offset homeowners with less than $200K mortgages, who tended to have slightly increasing delinquency rates.

CMHC said, “This suggests that smaller sized mortgages are generally held by borrowers with lower incomes and/or less stable employment than borrowers holding larger mortgages.”

The average Equifax credit rating in Greater Victoria and Metro Vancouver both increased by one point, on a year-over-year basis, to 780 and 776 points respectively. These figures have been steadily increasing since 2014.