Home sales across the province may be soft so far this year compared with the last couple of years, but this won’t be enough to bring average prices down, according to a forecast by the British Columbia Real Estate Association (BCREA).

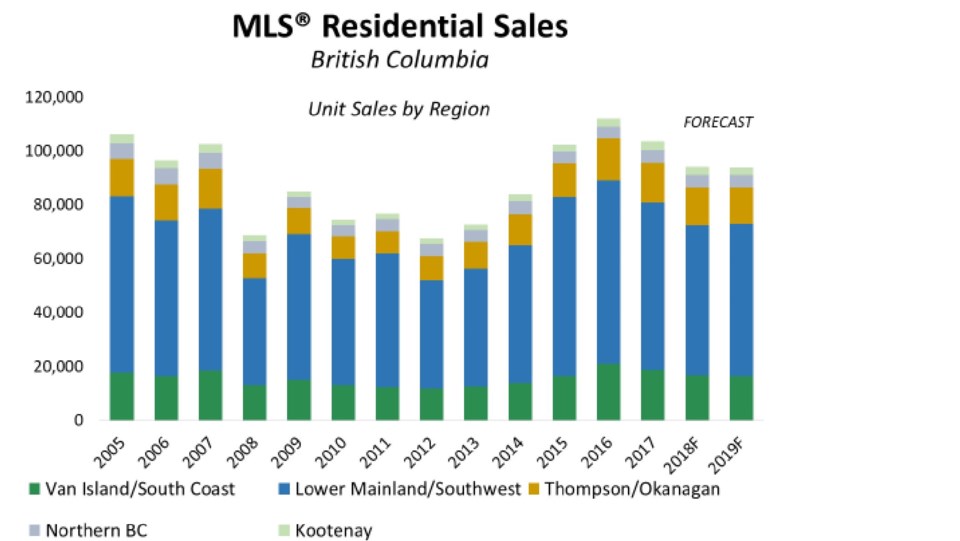

In its quarterly outlook, the BCREA predicted that B.C. residential resales will fall nine per cent to 94,200 units this year, following 103,700 unit sales in 2017, and stay flat in 2019. However, the BCREA said that sales are “expected to remain above the 10-year average of 84,800 units into 2020.”

The report said the average B.C. home sale price this year would be $745,600, which is 5.1 per cent above 2017’s $709,577. BCREA predicted a further growth of 4.1 per cent next year, to $775,900. This average includes all property types and all regions of B.C., and doesn’t take into account larger variables between different property types and regional or neighbourhood sub-markets.

“The housing market continues to be supported by a strong economy,” said Cameron Muir, BCREA chief economist. “However, slower economic growth is expected over the next two years as the economy is nearing full employment and consumers have stepped back from their 2017 spending spree.”

Greater Vancouver home sales on the MLS for the whole of 2018 will total 37,200 units, said the BCREA. This would be a drop of 10.7 per cent compared with 2017 – but the association said resale transactions would recover somewhat in 2019 to rise 3.7 per cent.

The report predicted the average Greater Vancouver home sale price in 2018 will be $1.08 million, which is 4.7 per cent higher than 2017’s average price. BCREA added that it expected a continued slight rise of 2.3 per cent next year, to just over $1.1 million.

“Demographics will play a key role in the housing market over the next few years,” added Muir, “as growth in the adult-aged population is bolstered by immigration and the massive millennial generation enters its household forming years.”