Battistella Developments, a homegrown Calgary builder, is bringing a 19-storey concrete tower out of the ground in the Beltline, nakedly aiming its 177 condominiums at the investor market.

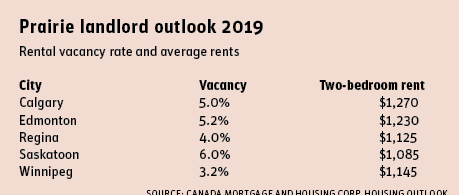

This is in a condo market that even the Calgary Real Estate Board describes as oversupplied and where the rental vacancy rate is at 6 per cent.

But Nude, as the tower is called, sold 20 condos in the first month of marketing, though it won’t complete until 2021.

“We are bullish on the Calgary rental market,” Chris Pollen, Battistella’s director of sales and marketing, told Western Investor in November. He explained that the rental vacancy rate in the Beltline is closer to 3 per cent and that recent new concrete rental towers in the zone are fully tenanted. Unlike B.C., Alberta has no foreign-buyer tax, no speculation tax and no rent controls.

Rental investors, many from overpriced and underperforming Vancouver, may like the numbers.

While most investors have been ogling the Nude’s studio and one-bedroom apartments that start at less than $200,000, Pollen said that a two-bedroom, 800-square-foot penthouse with city views sells for $515,000 and would rent for up to $2,500 per month. Buyers can purchase with a 10 per cent down payment spread over a year as construction continues.

Battistella is not alone in deciding to pull the trigger on impressive multi-family residential projects in Alberta.

In Edmonton, Langham Developments is forging ahead with a twin-tower residential project that will boast 650 condos. Langham has started pre-sales and hopes to break ground next year on the first tower.

According to Canada Mortgage and Housing Corp. (CMHC), this may be an even more ambitious play than Battistella’s.

“There are signs of overbuilding in Edmonton’s multi-family market,” stated CMHC’s annual Housing Market Outlook, released in November.

CMHC, however, noted that Alberta’s economy “continues to recover from two years of recession” and forecast a steady rise in employment and in-migration, both of which have been declining following the 2014 oil-price crash.

Saskatchewan

Saskatchewan’s housing sector has been sluggish for two years, with 2018 starts projected to be fewer than 1,500 units, down from 1,923 in 2017. CMHC expects better job growth, and higher in-migration could push starts as high as 1,775 units in 2019. Provincial housing sales are also forecast to increase modestly, and average home prices could rise 10 per cent to around $319,000.

Regina’s home sales dropped this year and will see only a modest uptick in 2019, according to CMHC.

In Saskatoon, the rental vacancy rate is now 7.5 per cent, down from nearly 10 per cent a year ago, and it could drop to 6 per cent in 2019, but there will be meagre growth in rental rates, CMHC noted.

Manitoba

Winnipeg housing sales rose 8 per cent in October compared to October 2017 and hit the highest dollar volume ever achieved for the month. However, Winnipeg housing sales for the year were down 5 per cent from 2017.

The average detache-house price reached $323,001, a 2 per cent increase over the same period a year ago, according to CMHC.

The rental vacancy is forecast to remain at 3.2 per cent in 2o19, lowest among Prairie cities.