In a remarkable statement of confidence in Calgary’s new-home market, one of Canada’s largest residential developers has purchased 130 acres of land for a massive residential build.

Genesis Land Development Corp. reported that it has acquired 130 acres in north Calgary for $23.7 million. That price works out to about $187,000 per acre.

The transaction is forecast to close on September 25, 2019, subject to closing conditions customary for a transaction of this nature, Genesis stated in a release.

“The north Calgary area is experiencing solid growth and Genesis believes the land acquisition fits well with its existing land base in terms of location and time to market,” the statement added.

Genesis intends to develop the land into a residential community, with servicing slated to begin in 2020.

Upon completion, the community is expected to include more than 800 single-family homes and approximately seven acres of multi-family and commercial sites.

Iain Stewart, president and CEO of Genesis, stated, “These lands provide Genesis with an attractive, short-term residential development opportunity that leverages our expertise and strong balance sheet by reinvesting capital in Calgary real estate at an opportune time.”

The Calgary housing market is improving. August sales marked the fifth consecutive month in which inventories declined and sales improved, according to the Calgary Real Estate Board (CREB).

“We are starting to see reductions in supply across the resale, rental and new-home markets,” said CREB chief economist Ann-Marie Lurie.

The Genesis purchase follows the acquistion of 12 residential land parcels in the Calgary region during the second quarter of this year, worth close to $69 million. This included the $19 million that Homes by Avi paid for a 48-acre site along the Trans-Canada corridor in west Calgary. That works out to more than $390,000 per acre.

Calgary’s residential land development already includes the 84-acre West District by developer Truman. The project officially kicked off this summer and is to eventually include about 2,500 homes. As well, Melcor is working on its 59-acre Greenwich, a residential-heavy, mixed-use development of about 1,000 homes that started a year ago.

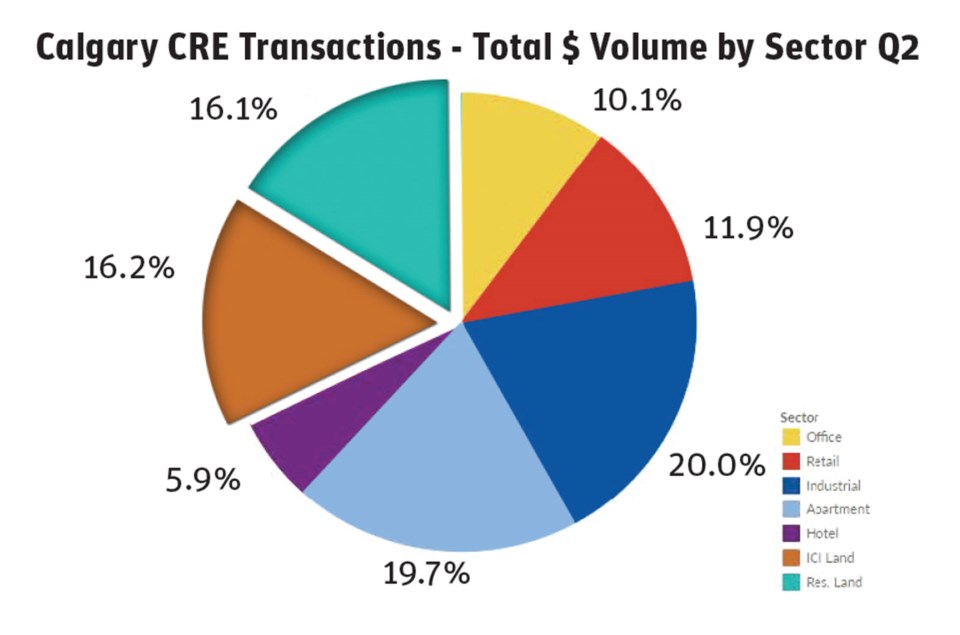

In all, residential land sales accounted for 16.1 per cent of commercial transactions in Calgary in the second quarter, with sales of land for industrial and commercial use accounting for a nearly identical 16.2 per cent of the action, according to Altus Group.

While the second quarter showed a steep decline in Calgary sales volumes from the same quarter last year, investment totals were down only 26 per cent during the second half compared to 2018, noted Ben Tatterton, manager, data solution at Altus.

Edmonton

Edmonton non-residential land was the only sector to post higher sales volumes in the second quarter than in the same period a year earlier, Altus Group reports, with sales up 17 per cent to $123 million. Most of the transactions were to owner-occupiers planning built-to-suit developments, not investors.

Other highlights of the Edmonton second-quarter report:

- Q2 volumes represented a decrease of 62 per cent from the same quarter last year and the third straight quarter of decline.

- The industrial sector represented 19 per cent of all transactions worth, $81 million, a decline of 73 per cent from Q2 2018.

- The apartment sector led the way in Q2 with 27 transactions representing a 31 per cent share of market activity.

- The office market held a slim 2.1 per cent share of total investments.

- The residential land sector accounted for 5.4 per cent of Q2 transactions.

One historic Edmonton land parcel is drawing fresh interest: the old Rossdale power plant waterfront area near downtown known as River Crossing. Last month city planners revealed fresh ideas for the site, mostly involving a mix of commercial uses and green space.