The entry in Calgary of co-working giant WeWork Companies Inc. has influenced positive net absorption of downtown office space in the city and contributed to a slightly lower vacancy rate – but Calgary’s office sector remains at risk, according to recent reports.

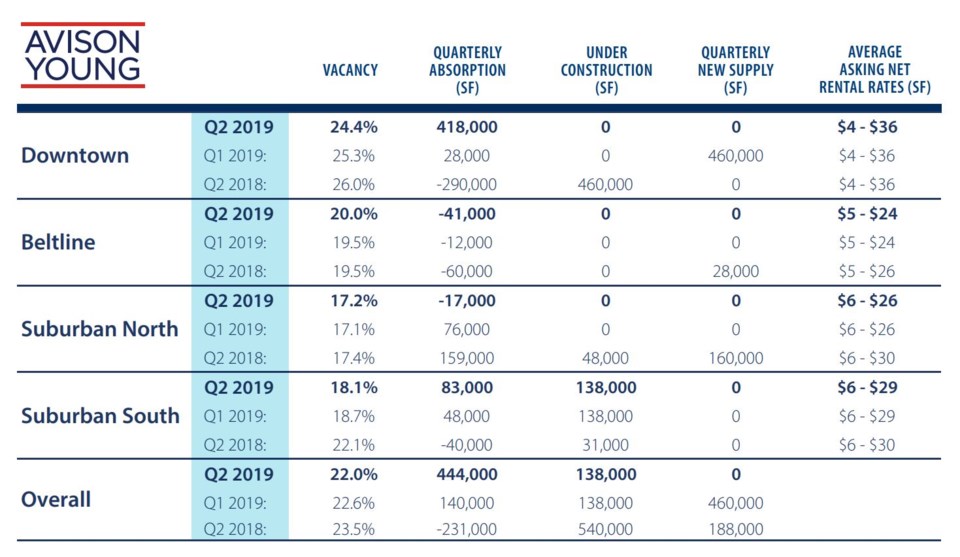

Commercial real estate services firm Avison Young Real Estate Alberta Inc. reported in its Q2 Calgary Office Market Report that Calgary’s downtown office vacancy rate was 24.4 per cent in 2019’s second quarter of 2019, down from 25.3 per cent in the first quarter and 26 per cent one year previously.

WeWork taking up a total of 10 floors of space in the downtown core contributed to this lower vacancy rate, along with a couple of other larger leases signed in Q2.

Over 446,000 square feet of downtown office space was leased in the first half of 2019, which exceeds the total downtown Calgary office space leased in all of 2018 (approximately 400,000 square feet), according to Avison Young.

The report said that the downtown office sector in Calgary was doing better than in the oil slump of recent years, which saw vacancy rates climb to 27 per cent. “Today the picture has improved, but remains challenged. WTI [West Texas Intermediate crude oil] is hovering around US$50 per barrel in June 2019. Downtown office vacancy around 24 per cent, and the unemployment rate remains stubbornly high... The main reason for the unemployment rate not decreasing as employment rises, is that more people are entering the labour force than there are jobs being created. Additionally, those jobs being created are generally not office-based employment.”

Avison Young concluded with a note of cautious optimism in its report. “The current outlook for Calgary’s office market is modest growth for the next year.”

CBRE Ltd., which also issued a Canadian Q2 office market report, pegs downtown Calgary office leases, year to date, at a similar 434,327 square feet, and the Q2 office vacancy rate at 25.8 per cent, a slight improvement over Q1.

However, the commercial real estate company said in its report that the office sector in Calgary is still facing a number of challenges. The report said, “Credit defaults and capital constraints continue to take a toll on demand for office space in Calgary as over 100,000 sq. ft. from four leases was given back to the market this quarter.”

It added, “New capital required to sustain and grow energy companies remains non-existent and if this trend continues it will have adverse effects on office demand.”

Both CBRE and Avison Young’s market reports identified the trend for “flight to quality” as posing a risk to landlords of lower-class office products. Avison Young’s report said, “Tenancies in the lower-class spectrum are now able to consider space in the better-quality buildings due to lower rent and increased availability of options.”