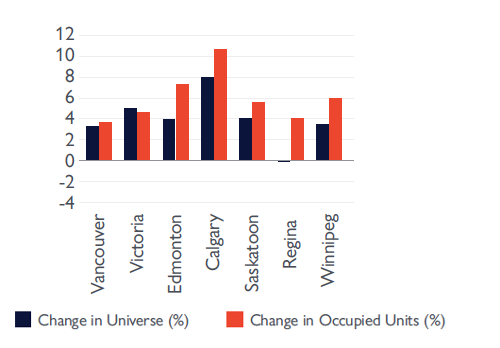

Strong tenant demand helped push down rental vacancies across Western Canada despite new construction, underscoring the strength of the sector.

Calgary and Edmonton led Canada with the strongest growth in occupied units last year, according to the latest rental market report from the Canada Mortgage and Housing Corp.

The number of occupied units increased by 10.7 per cent in Calgary last year outstripping 8 per cent growth in the number of purpose-built rental units.

Despite leading the country in terms of new units added, Calgary saw vacancies drop to 2.7 per cent, the lowest level for the city since 2014.

“Record migration into Alberta largely supported rental demand, while increases in supply were not enough to balance it out,” CMHC reported.

This pushed the average rent for a two-bedroom purpose-built rental apartment to $1,466 per month, up 6 per cent from last year. This was the strongest increase seen in any Prairie market. Investor-owned condominiums also saw rents increase, rising to $1,648 a month.

“With Calgary’s economy growing beyond pre-pandemic levels, the rental market tightened to conditions not seen since Alberta’s last economic boom,” Michael Mak, a senior analyst with CMHC noted of what lies ahead for 2023.

The shift towards tigher conditions in Calgary outpaced a similar shift in Regina, the only market in Western Canada to see zero net growth in its rental stock in 2022.

The lack of new construction in Regina, coupled with a 4.1 per cent increase in occupied units, cut vacancies in the purpose-built rental sector by more than half to 3.2 per cent, CMHC reported. Meanwhile, the average monthly rent for a two-bedroom apartment increased 3.3 per cent to $1,186.

But with no new purpose-built units, leasing activity has shifted to investor-owned condos, which often command a premium due to their location and amenities. However, even these have seen limited new construction.

“Higher building costs and supply-chain issues continue to hamper investment and limit rental supply growth,” CMHC reported.

This has pushed rents for investor-owned condos to an average of $1,467 a month, up 14.7 per cent versus a year ago. This is contributing to deteriorating affordability for the third of Regina households that rent. It also leaves little selection for the growing tide of newcomers to the city. Regina led the province in terms of new households last year.

Winnipeg, where vacancies were on par with Calgary at 2.7 per cent (down from 5.1 per cent last year), saw two-bedroom rents increase the least of any city in Western Canada – up just 1.5 per cent to $1,350 a month.

A strong economy and rising ownership costs for local housing contributed to stronger demand for rental housing in Winnipeg. Strong international migration also contributed to population growth and rental demand.

The number of occupied units in the city increased by 6 per cent, according to CMHC, outstripping net 3.5 per cent growth in new purpose-built rental units.

Overall, trends in Western Canada pointed to the region’s strongest rental market since 2014 as strong economic growth fuelled demand and high construction costs limited additions.

With most market segments seeing rents rise – the one exception being investor-owned condos in Winnipeg, which saw average rents fall 7 per cent to $1,301 a month – the outlook for landlords is bright.