RBC Economics’ quarterly report on housing affordability, issued June 26, painted a positive picture, noting that “owning a home in Canada is the most affordable it’s been in three years.”

While interest rate cuts continue to drive home ownership costs lower, with Vancouver showing the most improvement in Western Canada versus the previous quarter, RBC noted that housing costs remain “a long way from the more attainable pre-pandemic levels.” Indeed, challenging conditions persist in several markets, with Victoria seeing the sharpest decrease in affordability in Western Canada versus the previous quarter.

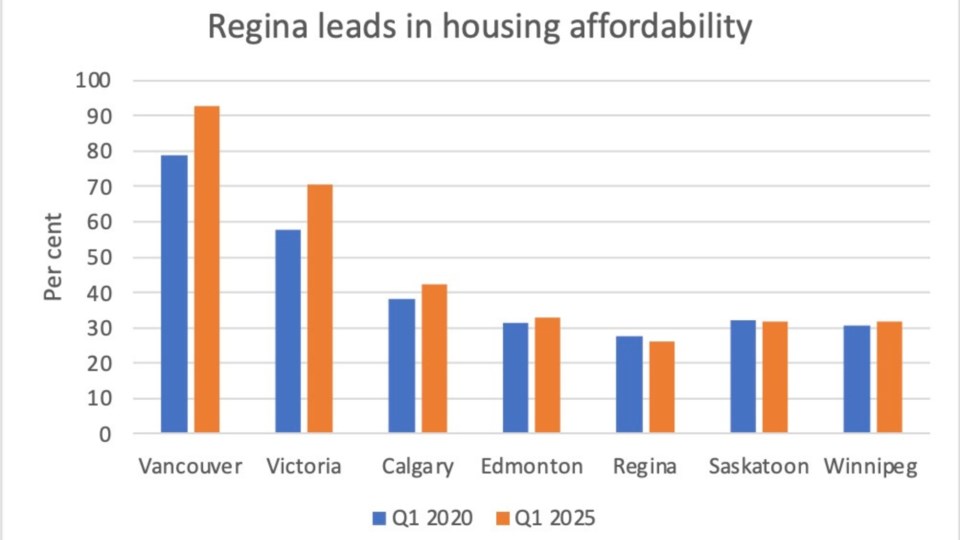

A comparison with affordability levels five years ago is instructive. In the first quarter of 2020, anticipating a hit from the COVID-19 pandemic, RBC noted that “recent housing affordability loss may prove temporary.” Five years later, just one market in Western Canada has seen an improvement in housing affordability.

Buying a home in Regina now requires just 26 per cent of monthly household income, down two percentage points from five years ago. Despite small improvements, affordability in Saskatoon is even with five years ago at 32 per cent, while Winnipeg, Calgary and Edmonton have seen affordability deteriorate. Yet Manitoba, Saskatchewan and Edmonton are all “affordable” by most measures, which indicate that households should spend no more than a third of their monthly income on shelter costs.

Vancouver remains the poster child for unaffordable housing, however, with home ownership requiring an average of 93 per cent of monthly household income, up from 79 per cent five years ago.