The province is expanding its controversial speculation and vacancy tax to six new communities in the Sea-to-Sky corridor and Cowichan Valley citing the need to create housing options – even though it can’t provide data backing up the need for the expansion.

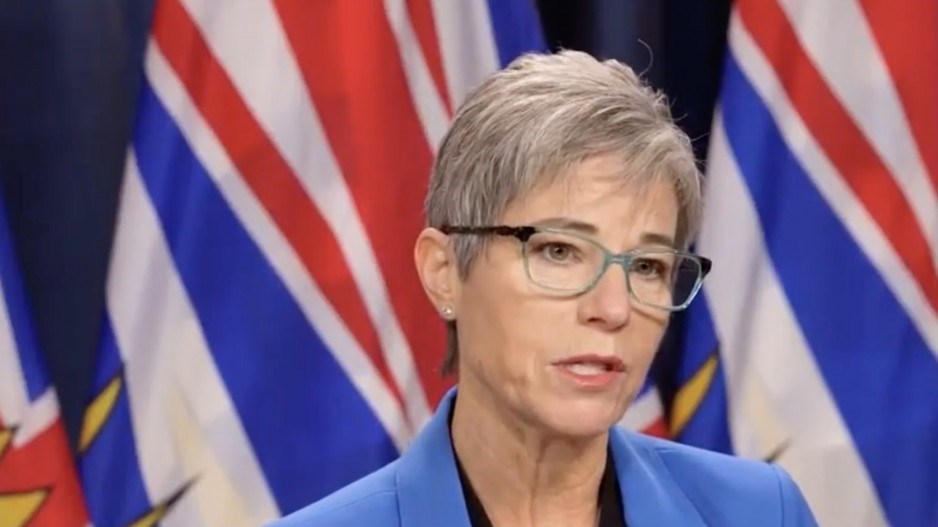

“This expansion will help prevent speculation from moving from one community to another in a region,” B.C. Finance Minister Selina Robinson said in making the announcement on July 20.

She positioned it as a defensive move, countering proposals by the BC Liberals (“Or whatever they’re going to call themselves,” she quipped) to cancel the tax.

“We cannot go back to the days of speculators treating housing like a stock market,” she said, while maintaining less than one per cent of property owners pay the tax.

The tax, levied on the value of unoccupied or underutilized residences, will now apply to Lions Bay and Squamish as well as the Vancouver Island communities of North Cowichan, Duncan, Ladysmith and Lake Cowichan. It takes effect in 2023 and will become owing in 2024.

The tax rate is 0.5 per cent of a home’s assessed value if the owner is a Canadian citizen or permanent resident of Canada who is not part of a satellite family. Foreign owners, including satellite families, pay a rate of two per cent.

Robinson said the new tax responds to low vacancies and high rental needs in the six communities, as well as real estate ads promoting the areas as ideal for investors because they were exempt from the speculation and vacancy tax.

Demographic shifts during the pandemic, which saw an outflux of city dwellers to rural areas, were also a factor.

The tax, debuted in 2018, currently applies to the Metro Vancouver and Capital Regional districts as well as Abbotsford, Chilliwack, Kelowna, West Kelowna, Nanaimo and Lantzville.

It does not apply to resort municipalities, meaning that Whistler, just down the road from Squamish, will be exempt. Properties accessible solely by air or water are also exempt, as are Indigenous lands.

The province also provides exemptions are also available for primary residences, properties with a long-term tenant and a number of other special circumstances.

The exemptions and exclusions mean the tax applies to fewer than one per cent of properties, Robinson said. Her ministry estimates that 320 homes could be returned to the rental market in the six communities as a result of the expanded tax.

“Given the smaller size of these communities, we expect this will make a meaningful difference for the people who will have homes in their communities,” a ministry statement said.

Squamish is estimated to see an additional 140 homes returned to the rental market. According to Canada Mortgage and Housing Corp. surveys, the primary rental market consists of 539 units with a vacancy rate of 0.4 per cent.

Real estate agent Ian Tang of Stilhavn Real Estate Services is active in both the Squamish and Vancouver markets and says expanding the speculation tax to the Sea to Sky corridor makes sense.

“When the speculation and vacancy tax was put in in the Lower Mainland, a lot of investors came this way, and it was even being advertised as a place that didn’t have it applied,” Tang said. “There’s definitely a ton of people here that have bought here as an investment to skirt that tax, and for a small town like this we really would prefer to have people live here when they buy, not just leave things empty.”

Tang says it’s only a matter of time before Pemberton is included. It’s already seen significant price increases, and he’s surprised it wasn’t included this week.

“There’s a ton of people moving their money up that way already, or being priced out of Squamish,” he said. “The misconception is realtors want markets to run away like they have over the past few years, but ultimately for the health of our communities and where we live, taking a small reduction in sales volumes to maintain the longevity of a community is way more important.”