Transactions of British Columbia residential real estate will become more complicated and monitored starting November 30, 2022, when the province’s new Land Owner Transparency Registry (LOTR) comes into effect.

The first such legislation in Canada, the searchable registry includes “information about interest holders under the Land Owner Transparency Act. These are individuals who do not have direct ownership of land but are considered to have some meaningful relationship with the land or an indirect ownership interest in it,” according to the Ministry of Finance.

LOTR was included in the 2018 provincial budget as part of a 30-point plan to address housing affordability. At the time the government said it was taking action to end hidden ownership of housing, which was suspected to be linked to money laundering or fraud.

The legislation was passed in May 2019, and it was to have come into effect in 2021 but was delayed until this year.

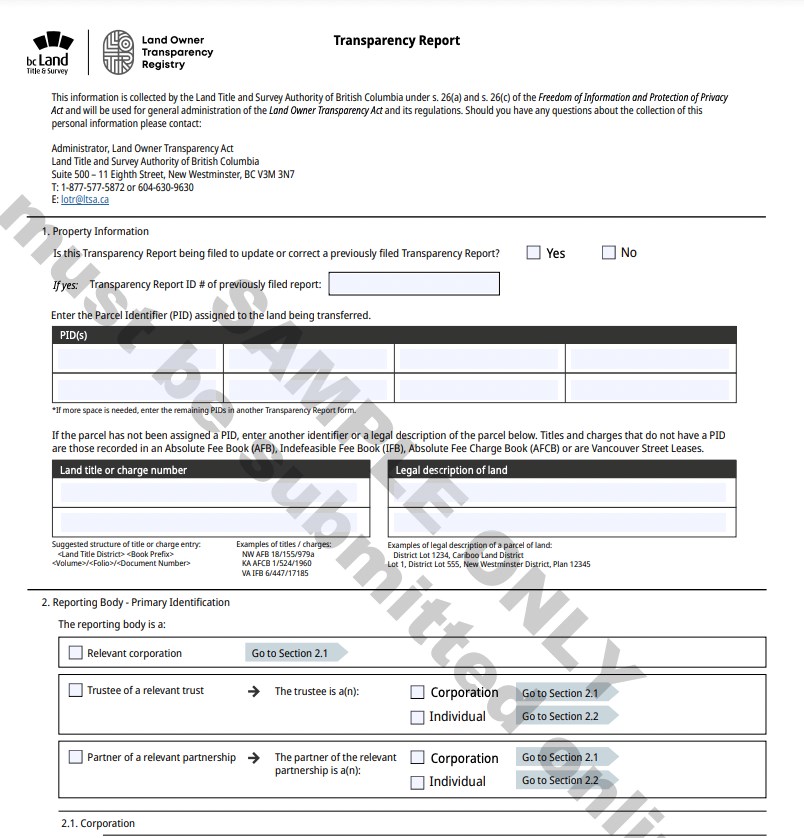

Under the LOTR, when an application is made to register an interest in land in the name of a relevant corporation, a trustee of a relevant trust, or a partner of a relevant partnership, a transparency report must also be submitted to the Registrar of Land Titles.

“The interest holders listed on a transparency report must be a human being – and not controlled by anyone else,” according to the province.

The Registrar of Land Titles will refuse to accept an application to register an interest in land without a transparency declaration. The fee for filing an LOTR application is $7.50 but filing the mandatory 23-page report costs $50 and it costs $150 to make corrections or change any information once it has been filed.

Penalties for not filing the report, or providing false information, can result in a $50,000 fine for a corporation or $25,000 for an individual, or 15 per cent of the assessed value of the property. The average value of a house with land in B.C. is close to $1 million.

Other offences under the act, not named, may be subject to a fine up to $100,000 for corporations or other entities, or $50,000 for individuals.

While it may appear difficult to prove if someone has “some meaningful relationship” with the residential land, real estate companies contacted appear ready for the LOTR, since it was originally to be introduced in November 2021.

“We search the data base as part of our policies now and will continue to do so, as part of our obligations of knowing our client,” said Kevin Skipworth, managing broker and partner with Dexter Realty, Vancouver.