After a drop in home sales in the early part of 2019, B.C.’s residential real estate market is recovering “much quicker than anticipated,” according to a report released November 25 by Central 1 Credit Union.

The rebound in activity is “driven by lower mortgage rates, first-time buyer incentives and population growth boosted by international migration,” Bryan Yu, the credit union’s chief economist, wrote in his forecast.

Yu wrote, “After a plunge in early year sales, B.C.’s housing markets have found themselves on firmer footing with MLS sales up in seven of eight months since February. The demand environment has improved, despite many prospective buyers remaining on the sidelines due to federal government mortgage stress tests and various provincial tax measures, which continue to curtail purchases by both domestic and foreign buyers, specifically in the highest priced urban areas like Metro Vancouver.”

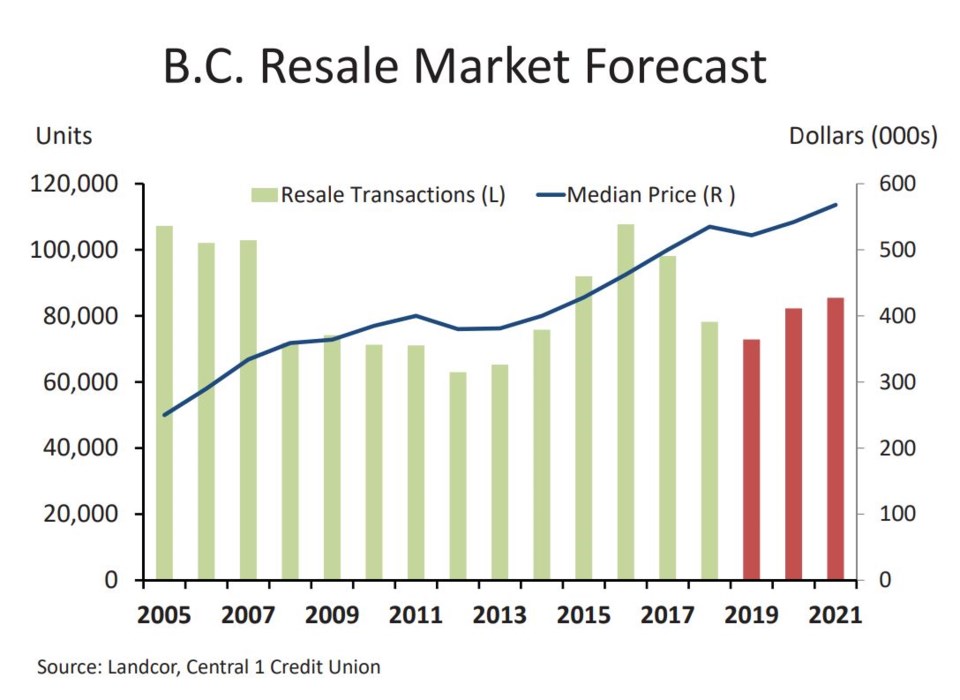

The higher demand will mean home sales across the province will rise 12.9 per cent in 2020, following three years of annual declines in residential transactions, said the report. That rise will not be enough to rival the heady days of 2015-2017, however.

But the same cannot be said of median sale prices, which Central 1 expects to break new records in 2020, and again in 2021.

The graph above shows that after a downwards blip in 2019, in which the median price is expected to have fallen 2.4 per cent over the year to $522,000, the credit union is forecasting a rise of 3.8 per cent to a new record of $542,000 in 2020. This median will increase further to $568,000 in 2021, the report added.

Low mortgage interest rates are a key driver of the rise in activity, and this is expected to continue, according to Yu. He wrote, “For those with sufficient down payments, lower rates and prices are driving increased sales. The rate environment will continue to be favourable for buyers. We forecast at least one or possibly two cuts to the Bank of Canada’s overnight rate in early 2020 and range-bound yield for five-year Government of Canada bonds. Mortgage rates will edge down further. A modest rebound in rates is expected in late 2020 and 2021, but levels will remain low.”

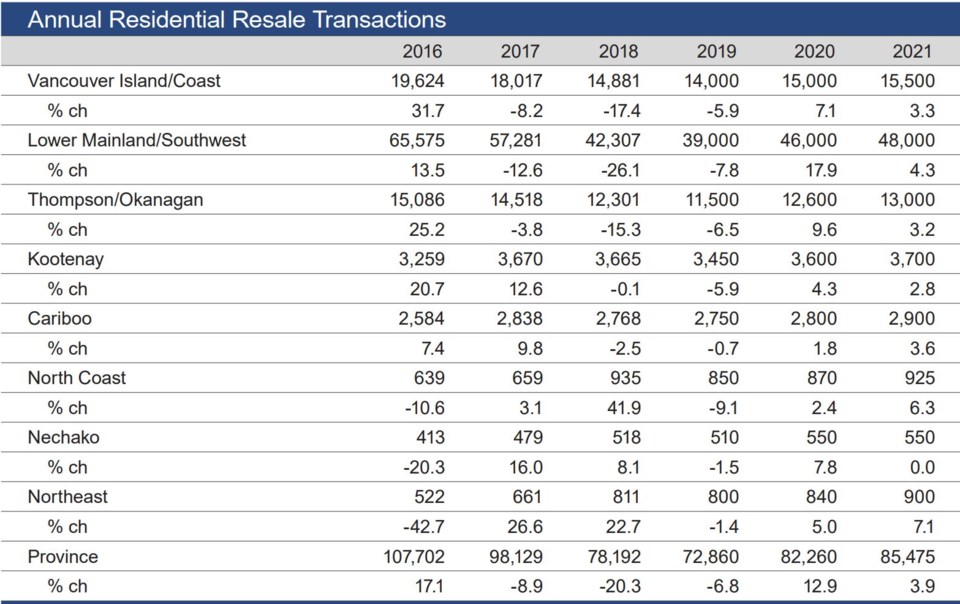

Central 1’s forecast echoed a recent forecast by the B.C. Real Estate Association in that it anticipated the greatest recovery in sales would come in the Lower Mainland, where the market had softened the most. Yu wrote that residential sales in the region are expected to pick up 17.9 per cent in 2020 compared with this year, with the Thompson/Okanagan slated to see the next-biggest rise in transactions at 9.6 per cent.

Across B.C., the demand for rental housing is also expected to keep rising, said the report.

“Home ownership remains out of reach for many households, at least temporarily due to demand constraining government policy. This will contribute to high levels of rental demand, persistence of low vacancy rates and rising rental rates. We anticipate an under supply of construction to emerge in the coming years in response to a weaker sales environment over the past two years, which could set the stage for another round of price escalation and rental hikes.”