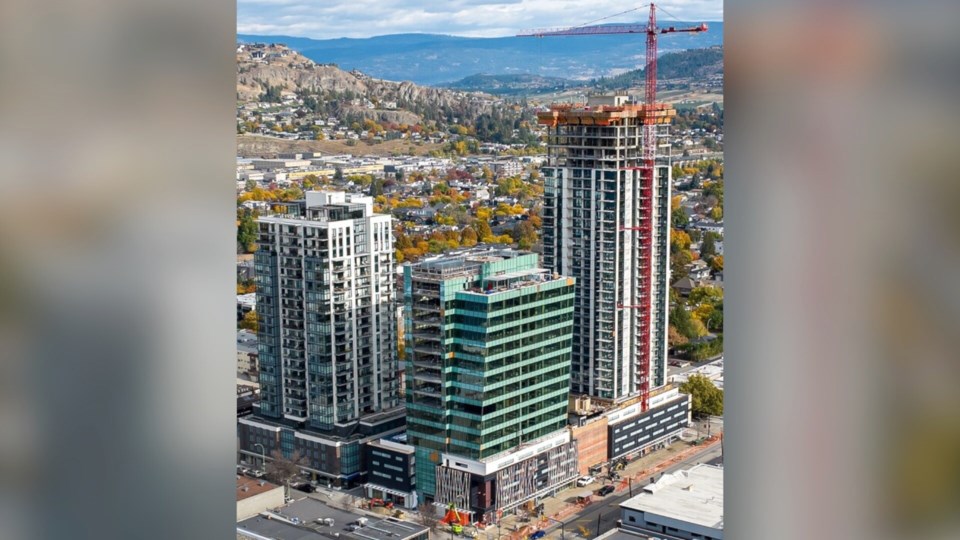

A decline in demand for office space in Kelowna has hit one of the largest real estate developers in the city.

Mission Group has shelved two future projects for the time being and let a handful of staff go. Rising costs and declining revenue are blamed for the postponement of two high-rise residential towers until conditions improve.

“Given the current market outlook impacting the entire development industry, Mission Group has decided to put two of our future projects on hold," said Mission Group CEO Jon Friesen in a statement to Castanet.

"These projects are downtown high-rise sites that have yet to move through the city approvals process and were originally planned to launch sometime in 2024. Market conditions have pushed that timeframe out."

The company did not specify which projects have been put on hold, however, projects listed as "coming soon" on its website include 346 Lawrence Avenue, a mixed-use condo project, and 1333 Bertram Avenue, a 157-unit, 19-storey rental tower.

Canada Mortgage and Housing Corp. released a report this week identifying rising interest rates, high construction costs and government taxes and levies as key factors frustrating efforts to build more housing, reinforcing the findings of a Central Okanagan survey of housing needs.

In a recent email to Mission Group staff, Friesen said pre-leasing levels at the Block office building have fallen short of original estimates.

In addition to shelving the two future projects, five staff members have been let go.

"As a result of this overall economic climate, and to continue to ensure the strength of our company moving forward, we have made the difficult decision to reduce our staffing levels by five per cent, from 105 employees to 100," Friesen's statement to Castanet said.

Friesen says they have ensured departing employees have been treated fairly, with dignity and respect.

"We remain confident and committed to the local market and will reassess these projects as market conditions change over time,” says Friesen.

The downtowns of cities across North America have struggled with soaring office vacancy rates as many employees continue to work from home after the pandemic.

A report earlier this year by Colliers Canada found the national office vacancy rate could peak in 2024 at 15 per cent. Office vacancy in downtown Vancouver has increased to roughly 12 per cent, as of the beginning of December, up from two per cent just prior to the pandemic, according to Colliers data.

Similar data for the Kelowna area is not available. A balanced market is typically viewed as having a vacancy rate of between six and ten per cent.