Lower Mainland sales activity moderated in November, with owners further from the core holding off listing their properties as other priorities took hold.

The number of active listings continue to build in Metro Vancouver, creating the largest selection since the heady days of 2021, and remained elevated in the Fraser Valley despite slower activity last month.

“We’ve been watching the number of active listings in our market increase over the past few months, which is giving buyers more to choose from than they’ve been used to seeing over the past few years,” Andrew Lis, director of economics and data analytics with the Real Estate Board of Greater Vancouver said in his monthly analysis of sales statistics. “When paired with the seasonal slowdown in sales we typically see this time of year, this increase in supply is creating balanced conditions across Metro Vancouver’s housing market.”

The total number of properties currently listed for sale on the MLS system in Metro Vancouver is 10,931, up 13.5 per cent versus a year ago.

The sales-to-active listings ratio for November across all property types was 16.3 per cent. Based on long-term averages, the board says downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period.

The board’s composite benchmark price for Metro Vancouver residential properties in November was $1,185,100, up 4.9 per cent versus November 2022.

Fraser Valley Real Estate Board reported a 3.2 per cent increase in the benchmark price versus a year ago to just over $1 million.

The sales-to-active listings ratio for November in the Fraser Valley was 14 per cent, creating what the board described as “balanced conditions” in the market.

“With seasonality and high interest rates continuing to dampen sales activity, we expect to see sales slow further into early 2024,” said FVREB CEO Baldev Gill.

Board statistics indicate that properties spent approximately one month on the market, with detached homes spending 36 days on market, and townhomes and apartments enjoying greater velocity with just 29 days spent on market. While sales fell 8.1 per cent versus the previous month, it remained the second-most active November of the past decade.

Nevertheless, active listings fell to 6,254 in November, up 17 per cent versus a year ago but down 5 per cent versus the previous month. Year-to-date, new listings are down 9.4 per cent to 28,668.

“As we head into the holiday season, buyers and sellers are busy with other priorities and will most likely continue to wait on the sidelines,” said FVREB chair Narinder Bains. “We anticipate this holding pattern, defined by slow sales and declining new listings, will continue through the winter months until we see some downward movement in interest rates.”

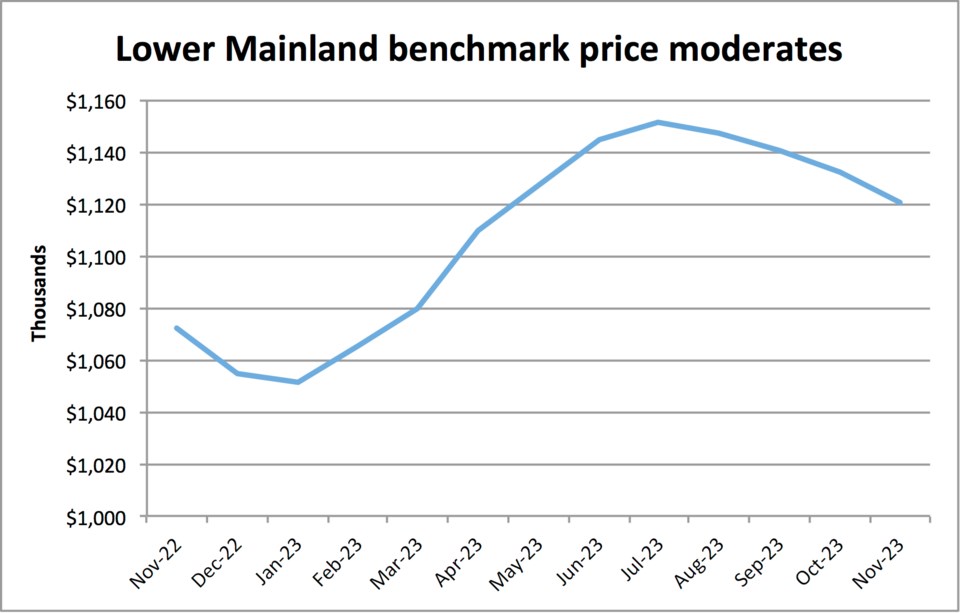

Regionally, the benchmark price for the Lower Mainland is now $1.12 million, up 4.5 per cent versus a year ago, indicating the resilience of pricing across the region despite the pressures on buyers and elevated inventories on a regional basis versus a year ago.