Last year, exploration spending in B.C. hit $660 million – just $20 million shy of the record $680 million spent in 2012. And according to Bruce Ralston, minister of Energy, Mines and Low Carbon Innovation, total production from B.C. mines in 2021 is forecast to be $12.6 billion, which would be an all-time high.

“It looks like 2022 is going to be an equally strong year,” Ralston said last week during the Association of Mineral Exploration (AME) annual Roundup conference at the Vancouver Convention Centre, which had 3,000 registered attendees, about 2,400 of whom were attending in person.

The Horgan government has been more supportive of mining than the NDP of the 1990s were. Horgan’s ministers acknowledge the role mining is playing in the energy transition needed to address climate change. That transition, which will require a massive amount of copper, nickel, lithium and rare earths, may be behind what one commodities analyst predicts is a new super cycle for certain metals.

“I do expect a super cycle for copper,” Patricia Mohr, former Scotiabank commodities analyst, said at a session on financial and commodities markets.

A global economy recovering from a pandemic-induced recession is driving demand for all commodities, and the energy transition is expected to amplify demand for metals that are critical to things like electric car batteries and renewable energy: copper, nickel, lithium, cobalt and rare earths. There are currently exploration projects in B.C. that are focused on nickel and rare earths.

Last year, copper hit record prices of US$4.88 per pound. Last week, Scotiabank Economics predicted that copper prices will average US$4.25 per pound for the next two or three years and hit US$5 per pound by 2025.

B.C. is Canada’s largest copper producer.

“It’s been a very impressive year,” Gordon Clarke, director of the mineral development office of the BC Geological Survey. “Mining and exploration programs … reached new heights in 2021.”

In 2019, lower copper prices led Imperial Metals to shut down its Mount Polley copper mine. Now, thanks to copper’s surge, the company plans to restart the mine this spring.

Several advanced stage projects, mine restarts and expansion projects were approved in 2021, including:

•December 2021: Ascot Resources Ltd. received a mining permit to restart the Premier Gold underground mine near Stewart, B.C., in the Golden Triangle.

•October 2021: Osisko Development Corp. received approval for the expansion of the Bonanza Ledge underground mine, which was previously part of the Barkerville Gold project.

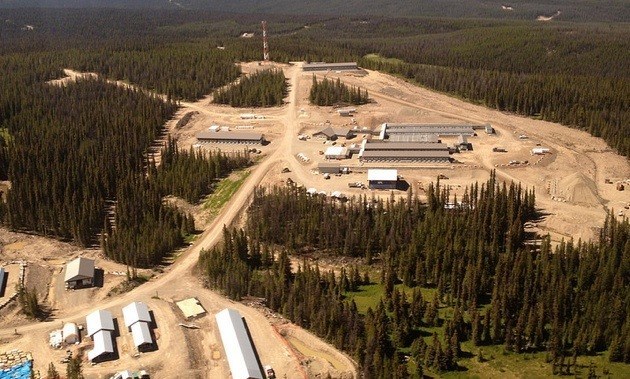

•July 2021: the Blackwater project, owned by Artemis Gold Inc.– and said to be the largest mine project proposed for the Cariboo in the last decade – got the green light for an early works permit.

As for promising exploration and development projects in the works, Ralston pointed to the Tudor Gold Treaty Creek project in northwest B.C.’s Golden Triangle.

“It may be one of the largest gold discoveries found in quite some time,” Ralston said.

He also pointed to the Lawyers gold-silver project north of Smithers and the Shovelnose gold project south of Merritt as potentially promising finds.

“Those are new, emerging projects that are still in the exploration side of the ledger, but we’re pretty optimistic about what’s going forward on these projects and many others,” Ralston said.

Mining accounts for B.C.’s second most valuable export, with metallurgical coal and copper being the most valuable. Mineral exploration is important, not only because of the money spent in B.C., but because it is critical to developing new mines and extending the life of existing mines.

More than half of the $660 million spent in 2021 on exploration was advanced exploration by mining companies with existing mines, and more than half of the exploration spending was for gold (54 per cent ), followed by base metals (29 per cent) and coal (11 per cent).

In B.C., 21 per cent of mineral exploration spending went to Indigenous-affiliated vendors, according to an AME economic analysis released last week, and 17 per cent of drilling companies are First Nation owned or affiliated. The Tahltan First Nation, for example, is a partner in Tahltech Drilling Services.

The average expenditure on a single mineral exploration project is $1.2 million.

“And over a five-year period, with a multi-area based permit, that number goes up to $11 million,” said AME president Kendra Johnston. “That’s the value of one individual project over five years.” •