The B.C. Budget, released today, February 28, is long on spending but short on help to the struggling business sector, according to the Greater Vancouver Board of Trade and the Canadian Federation of Independent Businesses (CFIB).

"B.C. budget spends big, leaves economy out," headlined the Budget response from the Board of Trade.

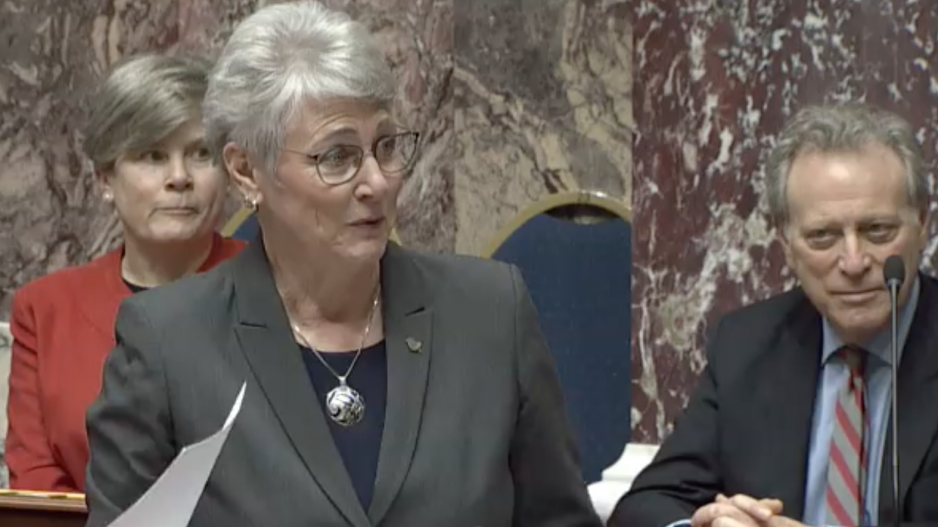

But non-profit housing groups are praising the first budget by Finance Minister Katrine Conroy because of its generous spending on social and rental housing programs.

The Budget is forecasting a $4.2 billion deficit over the next fiscal year.

The government also projected additional deficits of $3.7 billion in 2024-25 and $3 billion in 2025-26.

“Our members had hoped for measures to offset the rising costs of doing business but found no relief in Budget 2023,” said Bridgitte Anderson, President and CEO of the Greater Vancouver Board of Trade. “Unfortunately, the budget is essentially silent on an economic strategy to attract investment and increase our innovation capacity and competitive advantage. With a slowing economy and a growing population, we need a strong private sector and competitive investment conditions to increase prosperity across the province.”

Anderson said the Budget deserved a ‘C–' ranking, but noted some positive pro-business measures. These include:

• $480 million for the Future Ready Plan that will include mechanisms and funding to assist small and medium-sized businesses in finding practical solutions to labour market challenges and to prepare for a changing global economy

• $6 million for the development of a new critical minerals strategy.

The CFIB failed to see positives.

“BC small businesses are struggling to cope with inflation, lower consumer spending, higher interest rates, and ongoing labor shortages,” said Jairo Yunis, CFIB economist for Western Canada. “Sadly, despite the severity of the situation, the government decided to leave small businesses out of its spending priorities.”

Yunis said the government has hurt small business by increasing the carbon tax and “indexing school property tax rates to inflation.”

The Budget is heavy on spending for the housing file, however, which was applauded by the BC Non-Profit Housing Association (BCNPHA).

The Budget includes $4.2 billion to address inflationary costs in the Building BC portfolio of programs and doubles the number of homes in the Indigenous Housing Fund, from 1,750 to 3,500, noted Jill Atkey, CEO of the BCNPHA.

There is also a further $1.5 billion in operating and capital funding to reduce homelessness, and the Budget provided the first increase in welfare shelter rates since 2007, to $500 per month.

A long-promised Renters Tax Credit of $400 per year is also included. It is to start in 2024 for those eligible under a means test.

These measures are in addition to last month’s announcement of a $500-million Rental Protection Fund to enable non-profit and co-operative housing providers to purchase existing purpose-built rental buildings, a measure that has attracted criticism for potentially stunting new rental development.