The Bank of Canada held the line on interest rates this morning, with its latest policy announcement keeping the bank’s benchmark policy rate at 5 per cent.

This is the second time since the last increase on July 12 that the bank has refused to raise rates, which have made home-buying less affordable and prompted many developers to hit pause on projects. With construction among a significant driver of both the B.C. and broader economy, the bank’s interest rate campaign has stoked fears of a recession.

“Any strength in spending that we’re still witnessing is really still coming from essentials,” Carrie Freestone of RBC Economics told bank clients earlier this month. “Canadian households are squeezed.” She noted that unemployment has increased at a pace not seen since the 2008 financial crisis.

“It really does look like things are recessionary, or appearing to be recessionary.”

The Bank of Canada agrees that economic activity is slowing, but emphasized its commitment to ongoing tightening.

“There is growing evidence that past interest rate increases are dampening economic activity and relieving price pressures. Consumption has been subdued, with softer demand for housing, durable goods and many services,” the bank stated. “However, in addition to elevated mortgage interest costs, inflation in rent and other housing costs remains high. … Corporate pricing behaviour are normalizing only gradually, and wages are still growing around four to five per cent. The bank’s preferred measures of core inflation show little downward momentum.”

The bank said housing resales across Canada have declined 33 per cent since February 22, while home prices nationally have dropped by an average of 10 per cent.

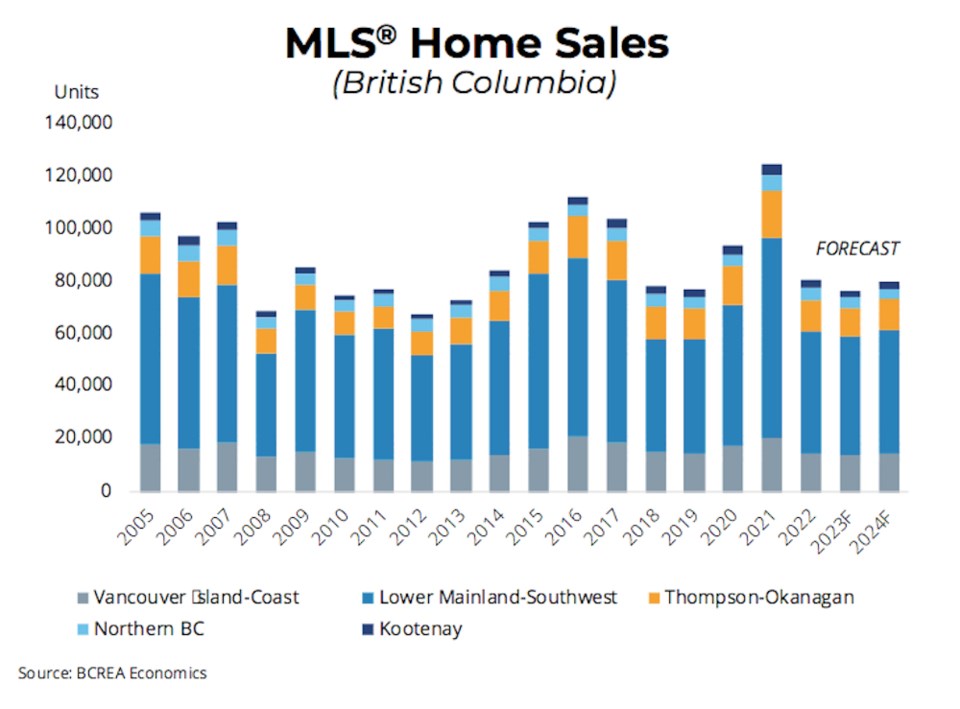

Within B.C., the fourth quarter outlook from the BC Real Estate Association forecast released the same day as the bank’s interest rate statement a 4.8 per cent decline in MLS sales this year. This would put volume at approximately 76,000, posing the market for a rebound in 2024.

“Activity in the B.C. housing market has mirrored movements by the Bank of Canada over the past two years,” said Brendon Ogmundson, chief economist with the BCREA. “Thankfully, it appears that the Bank is at, or at least very near, the end of its tightening cycle and may begin lowering its policy rate late next year.”

Ogmundson pointed to normalizing listings activity in the second half of 2023.

“Still, at just over 30,000 listings, the supply of homes for sale falls considerably short of the roughly 45,000 active listings that are historically consistent with a healthy, balanced market,” he noted.

While a tight supply typically means higher prices, the moderating effect of higher interest rates has led to a flattening as market conditions balance out.

“We expect a 1.9 per cent decrease in annual prices for 2023 compared to 2022, with a slight uptick expected in 2024, driven by a projected recovery in the latter half of the year,” he said.

The average residential price for B.C. is expected to close 2023 at $977,000, rising 1.6 per cent next year to $992,900.

Freestone told clients any recession in Canada would likely be mild.

“We’re expecting lending conditions will ease by next year,” she said, anticipating a 50-basis point cut in rates as early as the end of the second quarter.

The final interest rate announcement of the year is scheduled for December 6. The first announcement of the new year follows on January 24, accompanied by a policy statement that will give observers insight into the bank’s thinking on the economic outlook and future moves.