Multi-family sales have slowed by a third year-over-year, possibly signaling a shift in investor sentiment, according to a new report by HQ Commercial's the Goodman team.

The Goodman team’s third quarter Greater Vancouver report suggest that the 23 per cent decline in rental apartment sales may be due to recent interest rate hikes, stricter mortgage stress tests and government intervention.

Goodman believes these factors may have caused prospective buyers to remain as tenants, slowing down sales but increasing the value of multi-family stock.

“It’s expected many will forgo buying and continue renting. New mortgage stress-testing is certain to impact the ability of all types of home purchasers,” the report states.

New stress test requirements will see prospective buyers with less than 20 per cent down having to qualify for a mortgage at Bank of Canada’s five-year posted rate of nearly 5 per cent. The rate is higher than the discounted rate applicants would pay in reality.

Sales have decline from 148 buildings in Q3 2016 to 114 Q3 in 2017. Meanwhile, dollar volumes increased 35 per cent, led by in-demand redevelopment site sales. The majority of sales took place in Vancouver Eastside and Burnaby. Both areas have a supply of older apartment buildings ripe for redevelopment.

Dollar volumes in the suburbs – including Burnaby, New Westminster, North Vancouver, Surrey, White Rock, Maple Ridge and Coquitlam – have increased 86 per cent, while Vancouver values have increased a more modest 7 per cent. Total Matro Vancouver dollar volumes have increased from $1.24 billion in 2016 to $1.69 billion in Q3 2017.

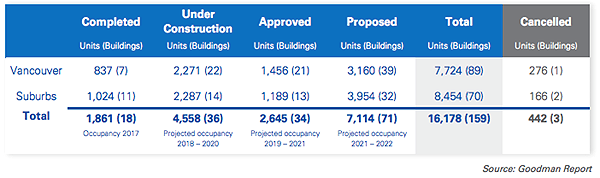

New supply is projected for Metro Vancouver’s rental stock by 2022, to the tune of 7,724 units in Vancouver and 8,454 across the suburbs. However, Goodman cautions that municipal intervention may prevent new projects from materializing.

“Are Metro Vancouver’s municipal governments really doing enough to address the dire shortages of market rental housing? We think not,” comments Goodman. “Proposed projects in our chart could quickly disappear should public officials adopt punitive polices that create disincentives for developers to build rentals.”

The city’s rental vacancy rate remains at 0.7 per cent, according to the Canadian Mortgage and Housing Corporation.