Victoria will accelerate into 2018 as B.C.’s second-busiest city for real estate development with existing major retail and residential projects surging forward and new ones firing up. The booming industrial sector is clamouring for space as the vacancy rate has fallen to near-record lows.

At the end of the third quarter of last year, the Victoria region had issued $117 billion in total building permits, up 1.1 per cent from the same time a year earlier. It appears that 2018 will be even higher.

Bosa Development, which bought Victoria’s Empress Hotel four years ago, has added Dockside Green to its Victoria portfolio as it plans to build out the mixed-use property.

Construction on residential towers will start this year, allowing people to move in two years later, said Ryan Bosa, president of Vancouver-based Bosa Development.

In December, Vancity credit union, through Dockside Green Ltd., sold Bosa the 10 acres of the 15-acre site that are still to be completed. The purchase price is not being released.

Provided the market remains relatively healthy, “I think eight to 10 years is a decent goal” for full build-out of the site, Bosa said.

The current plan is to design three towers at once. Two would be market condominiums, with a total of about 200 units. The other would be rentals, with possibly 125 units, Bosa said.

Dockside’s reworked master plan was approved by city hall this year. So far, about 300,000 square feet of space, with 266 residential units, has been built out.

Bosa is buying the right to build the remaining one million square feet allowed. Of that, more than 900,000 square feet is targeted for residential use, with the remainder for retail and office space, said Norman Shearing, president of Dockside Green Ltd.

Vancity Enterprisesand Windmill Developments started Dockside Green 15 years ago on a former city-owned industrial site, but development stalled following the 2008 economic downturn.

“The market is pretty strong right now in Victoria, so we are ambitious,” Bosa said.

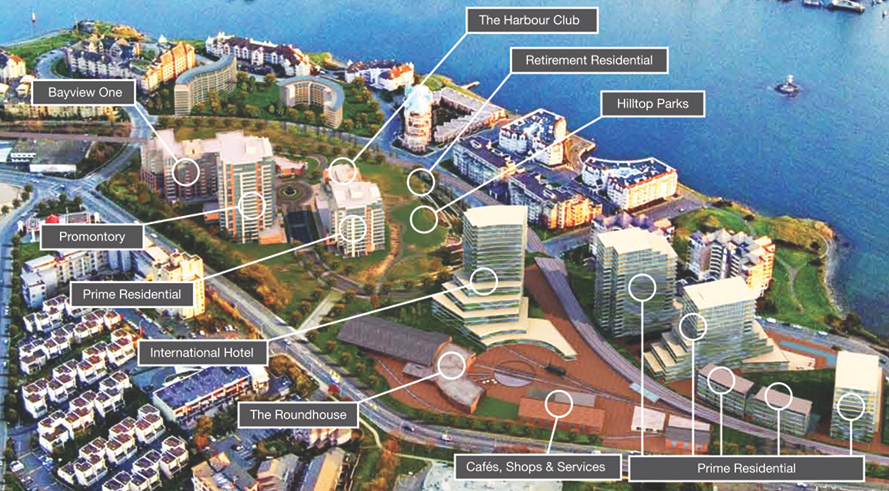

Another large Victoria West project, the ongoing Bayview and Roundhouse development by Focus Equities, will kick into a higher gear in 2018. Its 20 acres is framed by Esquimalt Road on the north, Kimta Road and Victoria harbour to the south, Tyee Road on the east and Catherine Street on the west.

A third residential tower – at 17 storeys – completes this year and is already sold out. Future condo buildings are planned for as high as 26 storeys.

Excavation is underway for a $75 million seniors residence on the site. Vancouver-based Element Lifestyle Retirement is behind the 153,000-square-foot facility that will have five storeys and feature 155 units to purchase or rent, and includes 35 licensed care units.

Developer Kenneth Mariash expects another six structures will be built, including a hotel and a heritage-style retail village.

At completion, the entire development is expected to be worth more than $1 billion.

Sidney

The $35 million Sidney Crossing retail project is expected to break ground this spring.

Work could start at the site — 10 acres located on airport land at Patricia Bay Highway and Beacon Avenue in March or April according to Omicron vice-president Peter Laughlin.

The Vancouver Airport Authority supports the development, and Omicron received rezoning and approval from the Town of Sidney in September 2016.

The 100,000-square-foot centre will include 10 buildings, with plans for anchor grocery and major appliance and electronics stores. Omicron has proposed a mix of retailers on site.

Industrial

All sectors of Greater Victoria’s real estate look strong for 2018 but the industrial market is seeing a seismic shift.

More than 281,000 square feet was taken up in the first half of 2017, the highest level in five years.

The region’s vacancy rate is sub-2 per cent, lowest in a decade; the average least rate is $12.50 per square foot, up from $12 a year ago and higher than in most of Metro Vancouver; and 75,000 square feet is under construction, and that is expected to reach 100,000 square feet this year.

Serviced industrial land prices have soared to more than $1.2 million per acre.

North Saanich/Sidney, with a 1.6 per cent vacancy rate and land available, and the Westshore, where Victoria Shipyards is expanding, are expected to lead the industrial action in 2018.

The new Sean Heights Business Park in Central Saanich has recently seen 20,000 square feet leased up and will complete a further 17,000 square feet this spring.

But experts warn that more new industrial space is needed.

“We are at a critical point where businesses don’t have any growth options. The lack of supply is limiting their ability to grow with our strong economy,” said Ty Whittaker, an industrial specialist and senior vice-president with Colliers International, Victoria.