Industrial and commercial strata opportunities are extremely rare in Kelowna, especially in a central retail location, but it is an increasingly popular choice for businesses that understand the value of building equity in their own company, and for investors who see the upswing in value in commercial property. Named by Western Investor as the number-one city to invest in real estate in Western Canada over the next year, Kelowna’s land values are set to rise again in the coming years. And with interest rates still at historic lows and land prices increasing, now is an opportune time to buy a commercial strata unit for your growing business.

“Rents in the Kelowna market are on the rise and in the long-term, owning is a prudent and profitable idea,” says Garry Fawley, principal at development company PC Urban. “For Kelowna companies, owning means they can have more capital to invest in tools and growing the business, rather than throwing the money away at rent. Believe it or not, it tends to cost 25 per cent more to rent rather than to own.”

Quality strata space in central Kelowna

IntraUrban Enterprise is Kelowna’s first industrial strata in five years. It’s set in an unparalleled location, in the heart of the city’s Okanagan shopping centre district. The centrally located, four-acre site will host 39 new commercial strata units on the major intersection of Enterprise Way and Dilworth Drive, one block off of Highway 97.

The new IntraUrban units will range from 2,700 to 4,200 square feet and will offer quality flex space for general industrial use with office and retail components. The development will feature bay garage doors, built-in upper mezzanines, generous glazing for natural light and a modern, high-end product that is rarely found in other industrial projects in Kelowna.

“The attractiveness of commercial condos is that, with a low interest environment, small business owners and investors both see real value in ownership,” says Steve Laursen, a broker with Royal LePage in Kelowna, which is co-marketing the project with CBRE. “These businesses are able to grow equity through their real estate. They’re able to improve space and reinvest in it knowing that they’ll benefit once the time comes to sell the property. There are tax breaks for them if they own their own property. They’re able to control their costs and expand or contract their business instead of being at the whim of a landlord. They control their own destiny.”

Record of commercial strata success

Last year, PC Urban launched a commercial strata development in the heart of Vancouver called IntraUrban Laurel. As in Kelowna, it was the first commercial strata within city limits in many years and it was a huge success, selling out before construction started – an unprecedented feat in the Vancouver market, one that highlighted the need for ownership opportunities for the city’s small and medium-sized businesses. PC Urban had a similar experience selling its second industrial strata project on Mitchell Island, just on the border of Vancouver and Richmond, called IntraUrban Rivershore. And the company is now bringing its experience with commercial strata to Kelowna’s burgeoning commercial real estate market.

“There is a rapidly closing window of opportunity for businesses to invest in their own commercial property in central Kelowna,” says Laursen. “IntraUrban Enterprise will be a premier industrial development due to its location, featuring unparalleled access to retail, downtown and main transportation routes for business space, as well as for recreational storage.”

Why buy commercial space?

Here are the top reasons to consider buying your own office or warehouse:

Here are the top reasons to consider buying your own office or warehouse:

Location: The long-term value play in real estate is always determined by choosing the right location, with easy access to retail, pedestrian traffic and transportation routes.

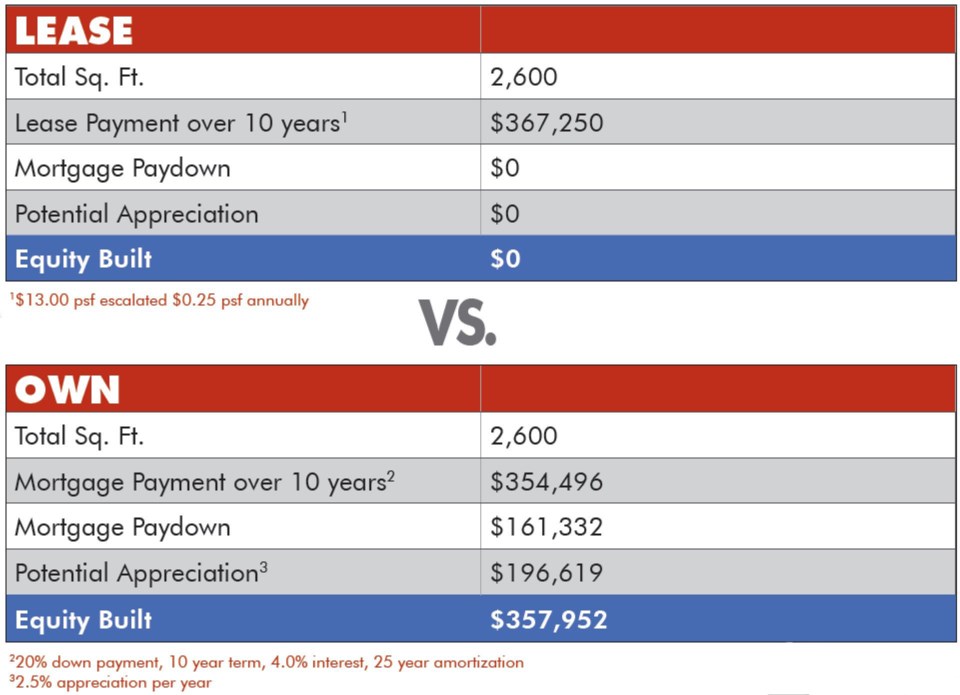

Growing equity: This is obvious, but easily forgotten. As you pay down your principal and your property appreciates, so does your equity. Over 10 years, the decision to own can result in large equity accumulation (see chart).

Rental hikes: This doesn’t happen when you own your own space. And stable mortgage rates offer the kind of stability and security leasing can’t provide.

Tax breaks: Depreciate your unit from its full value annually and write off operating and mortgage interest expenses.

Improving your space: Money you spend renovating – whether its upgrades to an office or a showroom – increases the value of your real estate and of your business.

Financial options: Your space can be rented or sold any time you want.

For more information on industrial strata in the heart of Kelowna, check out www.intraurban.ca/enterprise