Western Canada’s hotel sector is firing on all cylinders thanks to increased demand from both domestic and international investors in major markets such as Calgary and Vancouver.

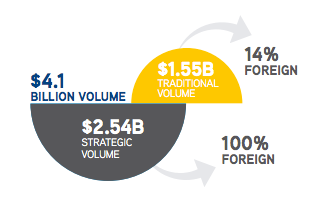

Canada’s lodging market provides foreign investors with an attractive, steady flow of capital thanks to stable political and legal environments, according to Colliers International. Colliers’ 2017 Canadian Hotel Investment Report states Canada’s hotel market recorded $4.1 billion in transaction value in 2016 and is on track to exceed $3 billion in volume in 2017.

“2017 is shaping up to be another banner one for the hotel industry,” said Robin McLuskie, vice-president, hotels, for Colliers International. “We expect foreign capital to keep flowing into our borders. We anticipate annualized supply growth to reach between 1.5 per cent and 2 per cent in the next two to three years. Hard-hit energy markets are rebounding, setting up these regions for increased activity. Plus the combination of Canada’s weak dollar and significant promotion around the country’s 150th anniversary should make 2017 a peak year for travel into Canada. These factors put the hotel real estate market on track towards yet another banner year.”

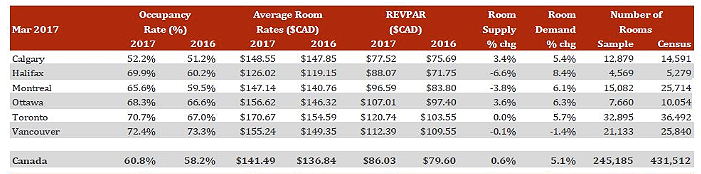

Revenue per available room (RevPAR) grew 5 per cent in 2016. Top-line revenues in Canada have grown by nearly 22 per cent since 2011, according to Smith Travel Research.

Historically, Western Canada average per-room prices have trended higher than those in Eastern Canada. However, limited supply coupled with the oil recession in the Prairies has caused transaction activity to slow in the West.

“Continued declines in operational performance in energy-linked markets including Calgary, Edmonton, Regina and Saskatoon impacted hotel valuations in 2016, however, values are expected to stabilize in 2017,” the report states.

Across all major markets, average room rates and RevPAR are expected to increase in 2017.

Foreign capital accounted for 67 per cent of total transaction value in 2016, or $2.75 billion. Canada’s low dollar is expected to continue to draw in foreign investment, primarily from Mainland China.