The provincial government has delivered on its promise to curb speculation and invest in affordable housing in its B.C. Budget 2018 announcement.

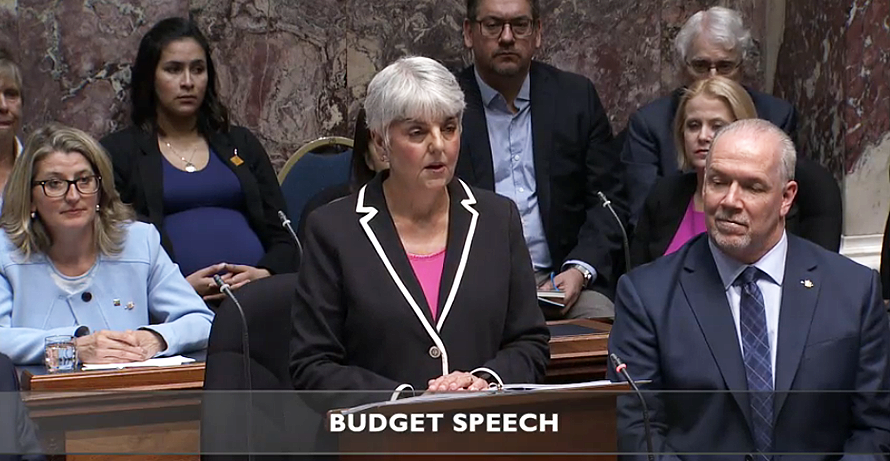

B.C. Finance Minister Carole James announced today (February 20) the province is expanding its foreign buyer tax to the Fraser Valley, Nanaimo, and Okanagan regions. The tax will be upped from its present rate of 15 per cent to 20 per cent, effective February 21. All homes over $3 million will see a property tax increase of 2 per cent, to 5 per cent in 2019.

“[Affordable housing] starts with stabilizing the market and curbing demand,” James said.

Demand

A new speculation tax is also coming into play beginning fall 2018. The tax targets foreign and domestic speculators who do not pay income tax in B.C., including those who leave their homes vacant. The tax will begin at 0.5 per cent of assessed property value in 2018 and rise to 2 per cent in 2019.

The province also hopes to stave off speculation by closing real estate tax loopholes by requiring more compressive information regarding condo presales and beneficial ownership (sometimes referred to as ‘shadow ownership’).

"B.C.'s real estate market should not be used as a stock market," James said. "It should provide safe and secure homes for families, renters, students and seniors. That's why we're cracking down on speculators who distort our market."

A database will track pre-sale condo assignments to ensure that those intending to flip properties pay the required taxes each time the condo changes hands in the process.

Requiring additional information regarding beneficial ownership and separate, specific land registry intends to do away with offshore companies and trusts that park capital in B.C.’s housing market while obscuring their identity.

Supply

The provincial government has promised over $6.6 billion in affordable housing funding over the next 10 years. This will go towards creating over 114,000 affordable homes for purchase and over 14,000 rental units.

A $450-million student housing program will allow post-secondary institutions to borrow directly from the province to facilitate new student housing, while $734 million will go towards building support housing for women and children fleeing violence.

The budget also promises 2,500 new supportive housing units for homeless British Columbians and 1,750 units of social housing for B.C.’s indigenous people.

Renters

Young people, low-income citizens and seniors will receive more rental assistance, by way of a $116-million increase to the Shelter Aid for Elderly Renters (SAFER) and Rental Assistance Program (RAP) benefits. On average, seniors will receive an extra $930 per year through SAFER, while low-income families will receive $800 more annual through RAP.

Read the entire Homes for B.C. housing strategy from B.C. Budget 2018.