Calgary is distancing itself from a reputation as a city with affordable rentals and, though per-door prices for multifamily assets remain relatively low, values are increasing.

The average monthly rent for an unfurnished one-bedroom unit in Calgary is up $206, or 13.9 per cent since November 2022, to $1,678.

This is the fastest annual rental increase in Western Canada.

In comparison, Edmonton saw its average rent for a one-bedroom increase to $1,209 month in November, up $165 from a yearly low of $1,044 in April.

Vancouver saw only a 1.94 per cent increase year-over-year, Liv.Rent reported, but its average rent for a one-bedroom remains the highest in Canada at $2,362.

A key reason for Calgary’s increase in rental demand – the vacancy rate is at 2.7 per cent, the lowest in 10 years – and per-door prices is high in-migration.

“The rate at which rents are increasing can be attributed to the influx of individuals moving to Calgary in search of more affordable living arrangements. Last year, the city experienced record immigration, and this trend shows no signs of abating,” according to NAIAdvent’s third-quarter (Q3) Calgary multi-family report.

Investors are taking note, confirms a recent study of the Network research team in Calgary.

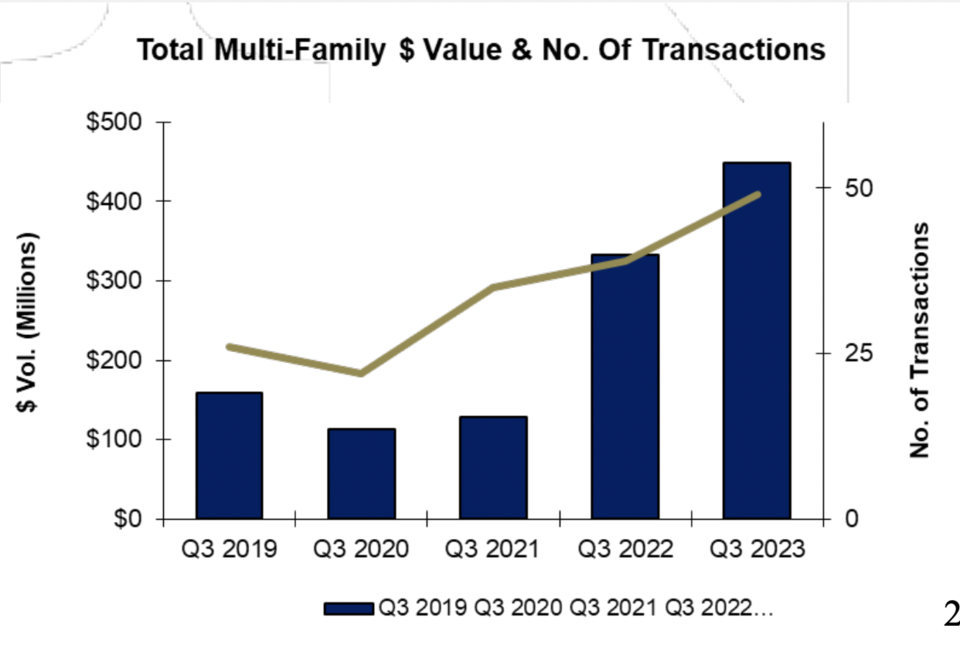

Investment in Calgary multifamily properties remained incredibly strong through the third quarter of 2023, with 22 transactions closing for a total of more than $177.4 million. To Sept. 30th, investment totalled just under $449 million, with multi-family properties transacting for an average of $202,900 per door, up significantly from $194,004 average a year earlier.

Capitalization rates came in at 4.5 per cent versus 4.1 per cent in 2022.

The largest transactions in Q3 were the $83.4 million purchase of the 304-unit Westview Heights by Westbow Real Estate Properties GP Inc. and the $20 million purchase of the 114-unit Edinburgh House by Surefire Ventures.

Investors are also firing up Calgary’s condominium sales which hit a record level of 641 transactions in October, as the sales-to-new-listing ratio hit a sizzling 88 per cent.

A decline in inventory levels has been driven mostly by condos priced below $300,000, which now represent only 38 per cent of all sales, a significant decline compared to the 53 per cent reported last year, according to the Calgary Real Estate Board.

The October condo benchmark price was $316,600 , a year-over-year increase of 16 per cent, with some of the largest gains arising in the lower-priced North East and East districts.

Residential land sales

Calgary is also seeing an increase in sales and prices for residential land, signally long-term confidence in the housing market.

The land asset class was the largest source of investment as of Sept. 30, 2023, with approximately $607.8 million invested over 128 transactions.

Dollar volume-wise, this represents more than double to investment seen in this asset class at the same period of 2019, 2020 and 2021 and a 56 per cent increase over Q3 2022 levels, the Network noted.

Nearly half of year-to-date dollar volume stemmed from 14 transactions of $10 million or greater. Three of those exceeded $25 million, with the largest being the $40 million ($143,000 per acre) purchase of 279 acres at 100 Street & 17 Avenue SE and the $36 million ($538,000 per acre) purchase of 67 acres at 6011 Country Hills Blvd NE.

Multifamily land led demand with 37 transactions closing so far in 2023.